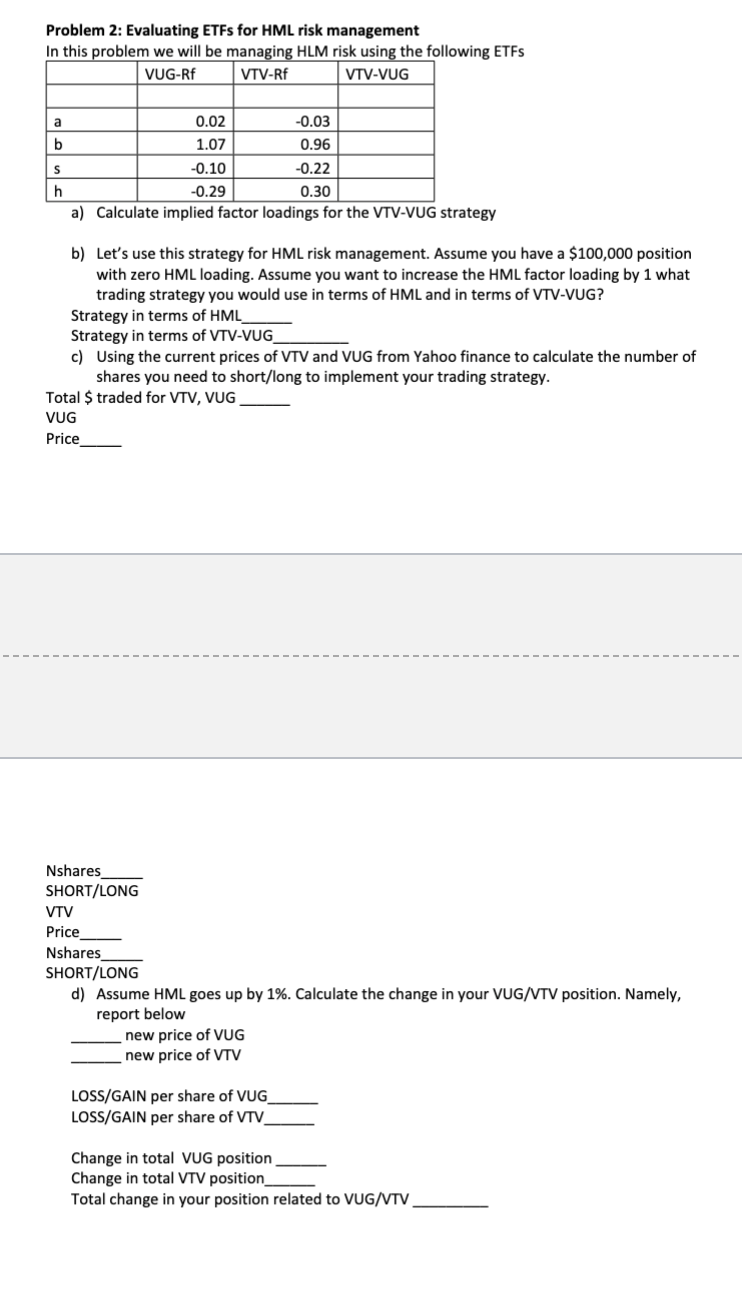

Question: Problem 2 : Evaluating ETFs for HML risk management In this problem we will be managing HLM risk using the following ETFs VUG - Rf

Problem : Evaluating ETFs for HML risk management In this problem we will be managing HLM risk using the following ETFs VUGRf VTVRf VTVVUG a b s h a Calculate implied factor loadings for the VTVVUG strategy b Lets use this strategy for HML risk management. Assume you have a $ position with zero HML loading. Assume you want to increase the HML factor loading by what trading strategy you would use in terms of HML and in terms of VTVVUG? Strategy in terms of HML Strategy in terms of VTVVUG c Using the current prices of VTV and VUG from Yahoo finance to calculate the number of shares you need to shortlong to implement your trading strategy. Total $ traded for VTV VUG VUG Price Nshares SHORTLONG VTV Price Nshares SHORTLONG d Assume HML goes up by Calculate the change in your VUGVTV position. Namely, report below new price of VUG new price of VTV LOSSGAIN per share of VUG LOSSGAIN per share of VTV Change in total VUG position Change in total VTV position Total change in your position related to VUGVTV Problem : Evaluating ETFs for HML risk management

In this problem we will be managing HLM risk using the following ETFs

a Calculate implied factor loadings for the VTVVUG strategy

b Let's use this strategy for HML risk management. Assume you have a $ position with zero HML loading. Assume you want to increase the HML factor loading by what trading strategy you would use in terms of HML and in terms of VTVVUG?

Strategy in terms of HML

Strategy in terms of VTVVU

c Using the current prices of VTV and VUG from Yahoo finance to calculate the number of shares you need to shortlong to implement your trading strategy.

Total $ traded for VTV VUG

VUG

Price

Nshares

SHORTLONG

VTV

Price

Nshares

SHORTLONG

d Assume HML goes up by Calculate the change in your VUGVTV position. Namely, report below

new price of VUG

new price of VTV

LOSSGAIN per share of VUG

LOSSGAIN per share of VTV

Change in total VUG position

Change in total VTV position.

Total change in your position related to VUGVTV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock