Question: Problem #2: Excel's Solver utility can also find an optimum solution involving more than one variable. We will use Solver to find the best fit

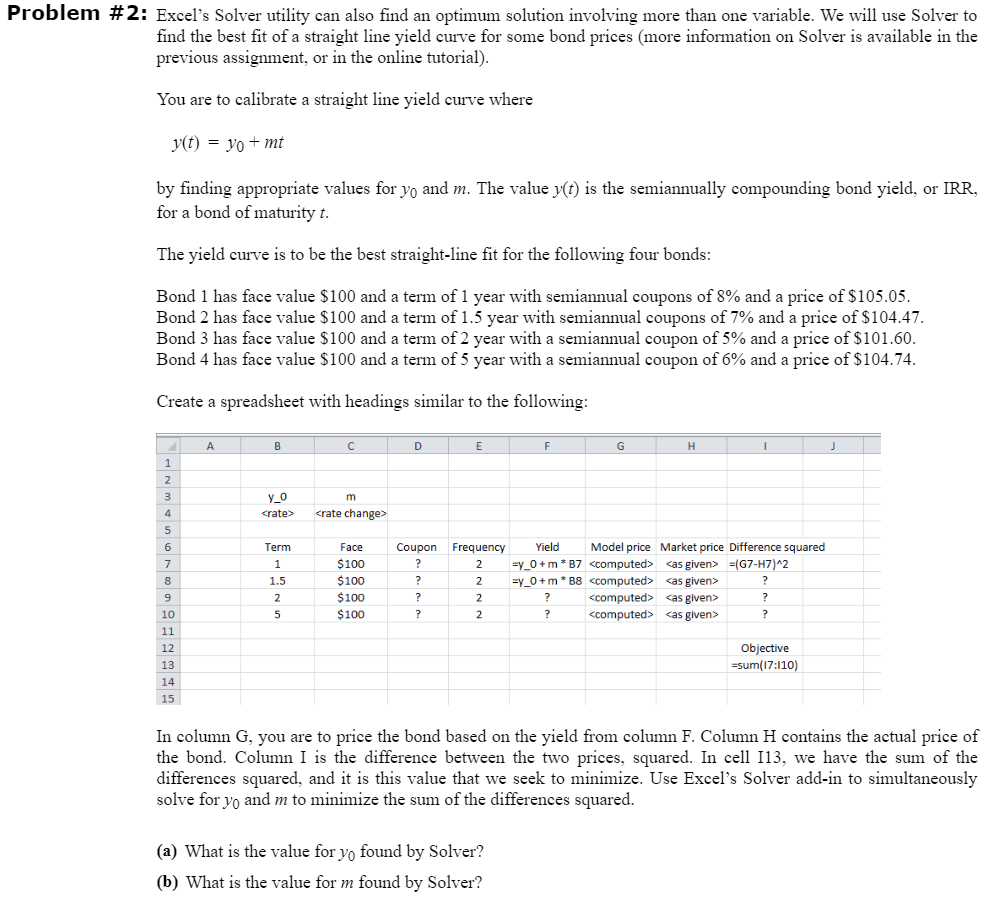

Problem #2: Excel's Solver utility can also find an optimum solution involving more than one variable. We will use Solver to find the best fit of a straight line yield curve for some bond prices (more information on Solver is available in the previous assignment, or in the online tutorial) You are to calibrate a straight line yield curve where by finding appropriate values for vo and m. The value v(t) is the semiannually compounding bond yield, or IRR for a bond of maturity t The yield curve is to be the best straight-line fit for the following four bonds Bond 1 has face value $100 and a term of 1 year with semiannual coupons of 8% and a price of $105.05 Bond 2 has face value $100 and a term of 1.5 year with semiannual coupons of 7% and a price of $104.47. Bond 3 has face value $100 and a term of 2 year with a semiannual coupon of 5% and a price of $101.60 Bond 4 has face value $100 and a term of 5 year with a semiannual coupon of 6% and a price of $104.74 Create a spreadsheet with headings similar to the following erate change> 6 Term Difference squared Face 100 100 100 100 Coupon Frequency Yield Model price Market price 2 y 0+m B7 op> asgiven> G7-H7)42 2 y 0+m B8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts