Question: Problem 2 : Financial statements (follow the tips for preparing financial statements) The information below discloses the un adjusted trial balance for the general fund

Problem 2: Financial statements (follow the tips for preparing financial statements)

The information below discloses the unadjusted trial balance for the general fund of the Village of Stoneville as of December 31, 2022. The Village is incorporated in the State of Illinois

Accounts Debits Credits

| Cash | 408,000 |

|

| Property taxes receivable | 40,000 |

|

| Vouchers payable |

| 83,000 |

| Due to other governments |

| 65,000 |

| Fund balance |

| 550,000 |

| Expenditures-general government | 2,164,000 |

|

| Expenditures-public safety | 3,298,000 |

|

| Expenditures-economic development | 492,000 |

|

| Expenditures-culture and recreation | 280,000 |

|

| Revenues-taxes |

| 4,400,000 |

| Revenues-permits and licenses |

| 1,220,000 |

| Revenues-intergovernmental |

| 300,000 |

| Revenues-fines and forfeits |

| 64,000 |

| Estimated revenues-taxes | 4,500,000 |

|

| Estimated revenues-permits and licenses | 1,200,000 |

|

| Estimated revenues-intergovernmental | 360,000 |

|

| Estimated revenues-fines and forfeits | 68,000 |

|

| Budgetary fund balance | 240,000 |

|

| Appropriations-general government |

| 2,198,000 |

| Appropriations-public safety |

| 3,400,000 |

| Appropriations-economic development |

| 500,000 |

| Appropriations-culture and recreation |

| 270,000 |

| Encumbrances: public safetycontractual services | 16,000 |

|

| Budgetary fund balance reserved for encumbrances |

| 16,000 |

| Totals | 13,066,000 | 13,066,000 |

Additional information:

- At December 31, 2022, the State treasurer notified the finance director of the Village that the State is holding $52,000 of sales taxes and $36,000 of income taxes. The State treasurer disclosed that the sales tax revenue would be remitted by the third week in January, 2023, and the income tax revenue would be remitted during the fourth week in February, 2023. All of the uncollected property taxes at December 31, 2022, are expected to be collected no later than March 1, 2023.

- On January 10, 2023, the finance department received a utility bill from Peoples Gas for $12,000. This billing was for natural gas usage during the months of November and December, 2022.

- Revenues from property taxes, as well as revenues from all other sources in the general fund, use the same time period for determining availability.

Required:

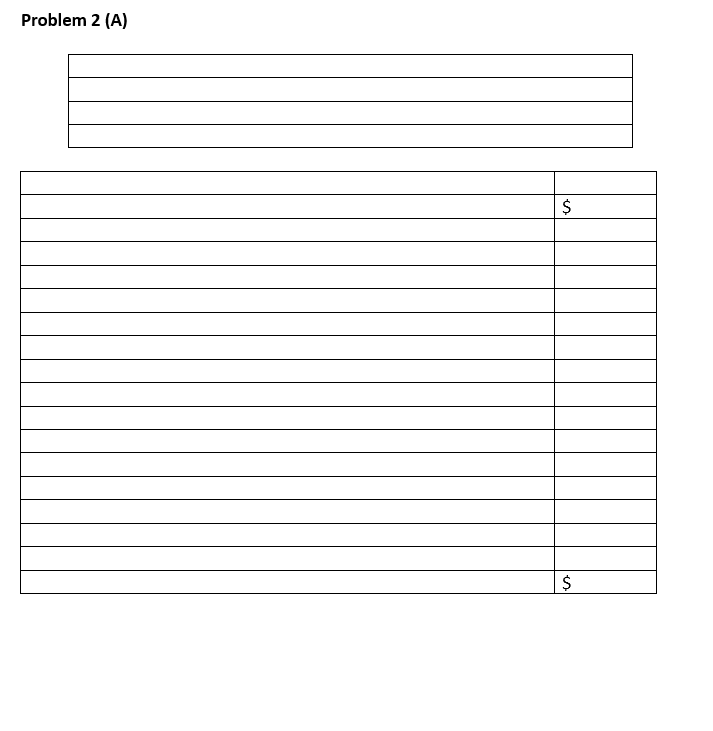

- Prepare the statement of revenues, expenditures, and changes in fund balance for the general fund of the Village of Stoneville for the year ended December 31, 2022.

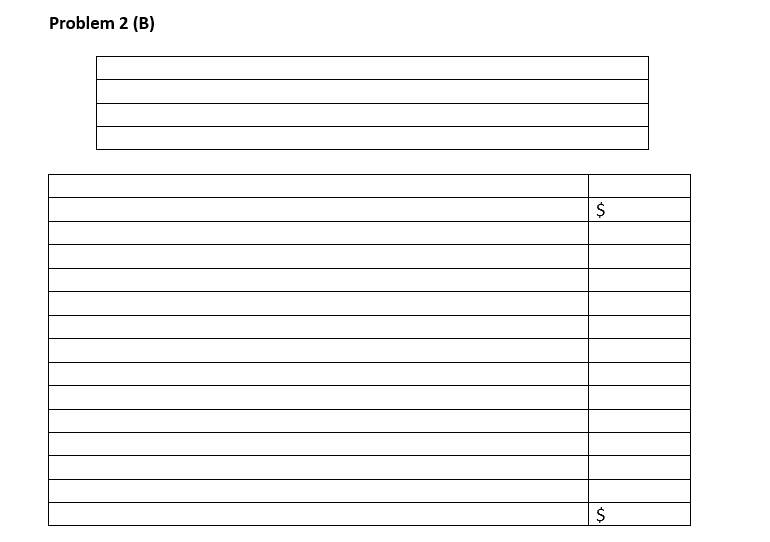

- Prepare the balance sheet for the general fund of the Village of Stoneville at December 31, 2022. All fund balance is unassigned.

Problem 2 (A) $ $ Problem 2 (B) $ $ Problem 2 (A) $ $ Problem 2 (B) $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts