Question: Problem 2. Financing & Valuation (25 points) A two-year project requires initial investments of $150 000. The project is initially financed by 40% equity and

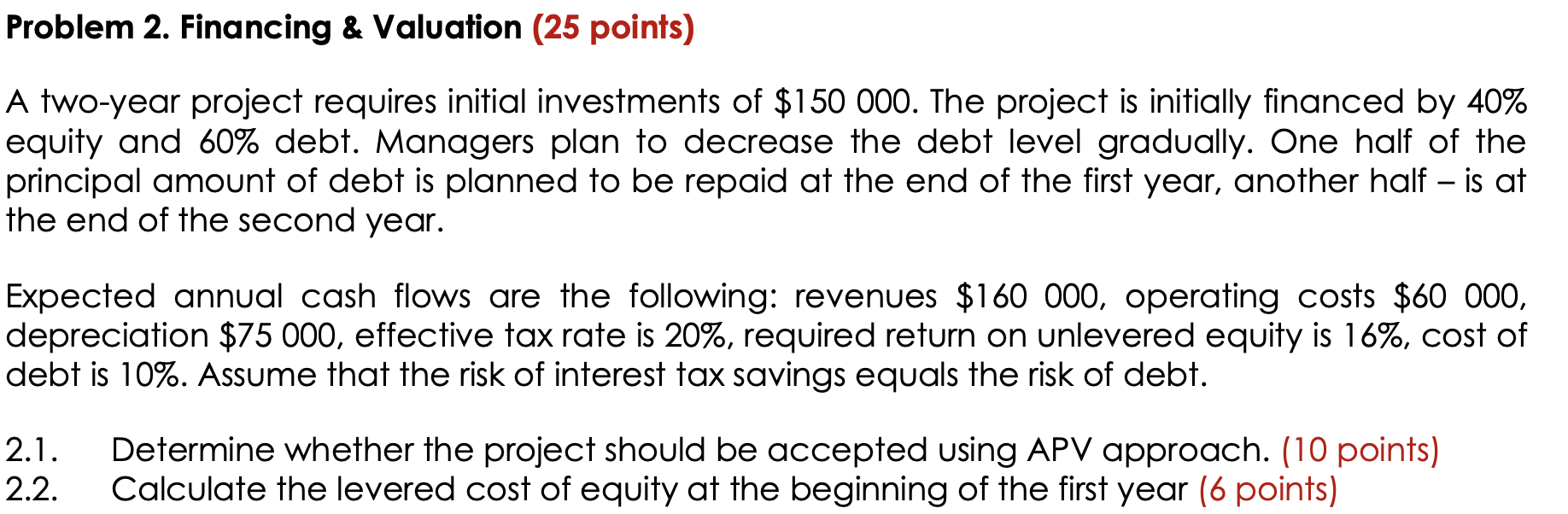

Problem 2. Financing & Valuation (25 points) A two-year project requires initial investments of $150 000. The project is initially financed by 40% equity and 60% debt. Managers plan to decrease the debt level gradually. One half of the principal amount of debt is planned to be repaid at the end of the first year, another half is at the end of the second year. Expected annual cash flows are the following: revenues $160 000, operating costs $60 000, depreciation $75 000, effective tax rate is 20%, required return on unlevered equity is 16%, cost of debt is 10%. Assume that the risk of interest tax savings equals the risk of debt. 2.1. 2.2. Determine whether the project should be accepted using APV approach. (10 points) Calculate the levered cost of equity at the beginning of the first year (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts