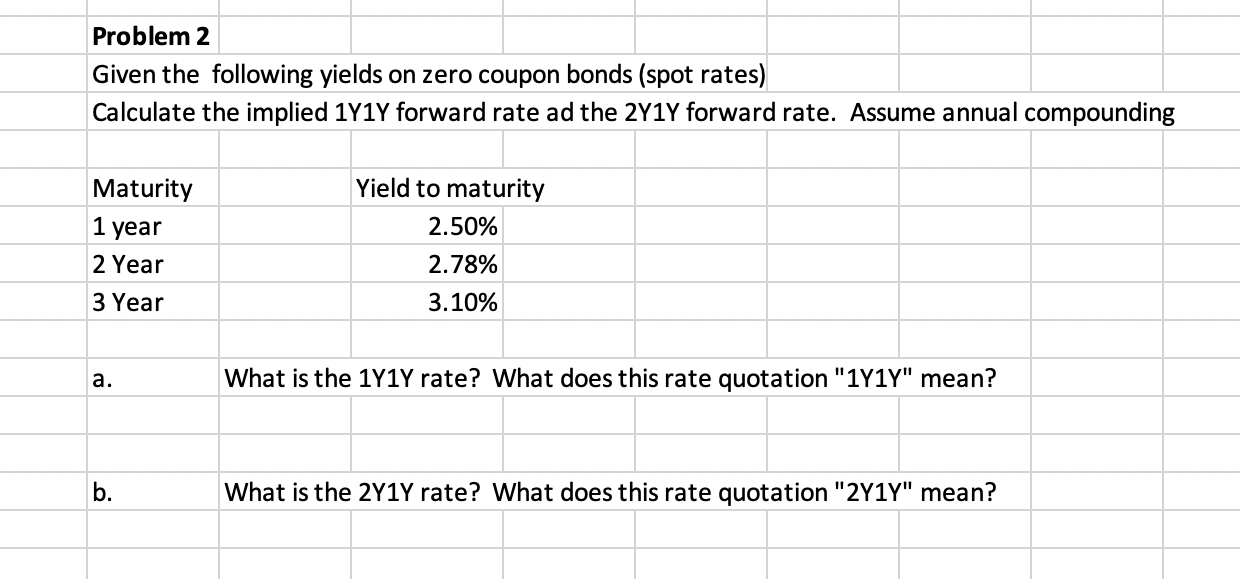

Question: Problem 2 Given the following yields on zero coupon bonds (spot rates) Calculate the implied 1Y1Y forward rate ad the 2Y1Y forward rate. Assume

Problem 2 Given the following yields on zero coupon bonds (spot rates) Calculate the implied 1Y1Y forward rate ad the 2Y1Y forward rate. Assume annual compounding Maturity 1 year 2 Year 3 Year Yield to maturity 2.50% 2.78% 3.10% a. What is the 1Y1Y rate? What does this rate quotation "1Y1Y" mean? b. What is the 2Y1Y rate? What does this rate quotation "2Y1Y" mean?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts