Question: Problem 2: Given the net cash flows for Project X (over 3-years) for Aberdeen Company Year CF 0-$300,000 1 $120,000 2 $128,000 3 $155,000 The

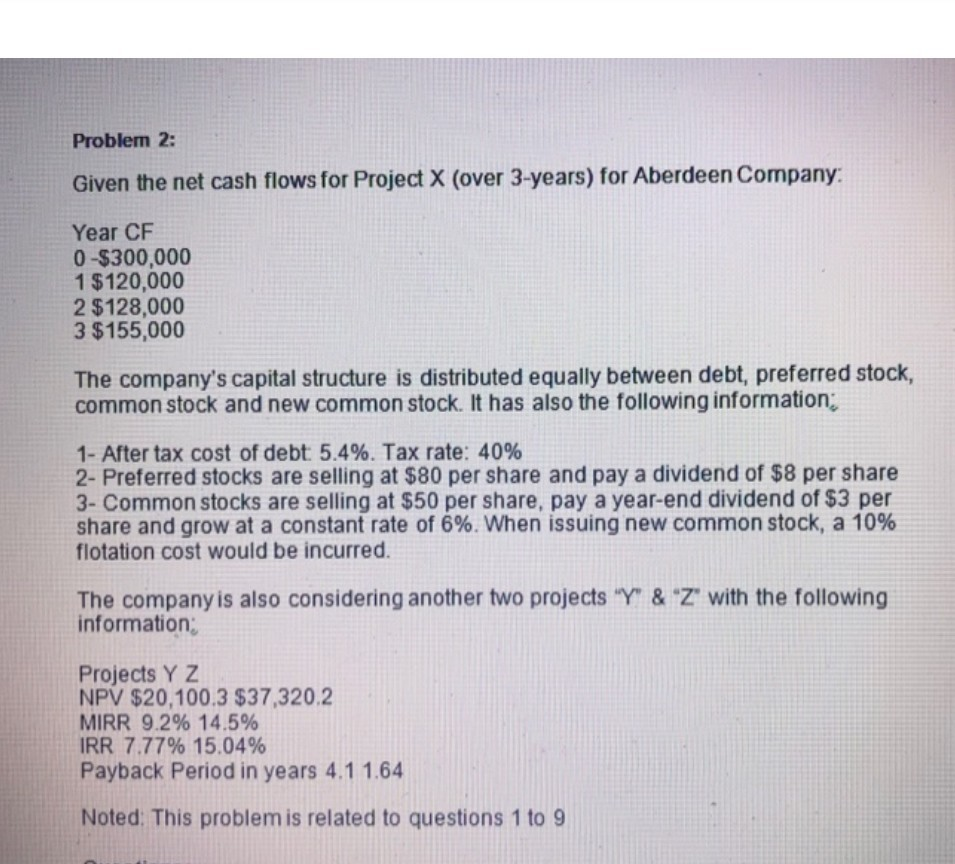

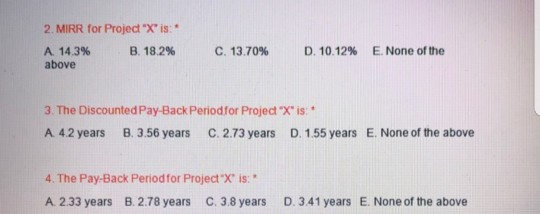

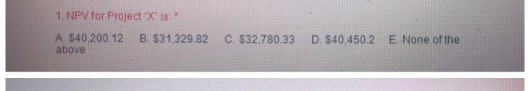

Problem 2: Given the net cash flows for Project X (over 3-years) for Aberdeen Company Year CF 0-$300,000 1 $120,000 2 $128,000 3 $155,000 The company's capital structure is distributed equally between debt, preferred stock, common stock and new common stock. It has also the following information: 1- After tax cost of debt: 5.4%. Tax rate: 40% 2- Preferred stocks are selling at $80 per share and pay a dividend of $8 per share 3- Common stocks are selling at $50 per share, pay a year-end dividend of $3 per share and grow at a constant rate of 6%. When issuing new common stock, a 10% flotation cost would be incurred. The company is also considering another two projects "Y" & "Z" with the following information: Projects Y Z NPV $20,100.3 $37,320.2 MIRR 9.2% 14.5% IRR 7.77% 15.04% Payback Period in years 4.1 1.64 Noted. This problem is related to questions 1 to 9 2. MIRR for Project "X"is: A. 14.3% B. 18.2% above C. 13.70% D. 10.12% E. None of the 3. The Discounted Pay-Back Period for Project "X"is: * A. 42 years B. 3.56 years C. 2.73 years D. 1.55 years E. None of the above 4. The Pay-Back Period for Project is: A 2.33 years B.2.78 years C. 3.8 years D. 3.41 years E. None of the above 1. NPV for Project X is: A $40,200.12 B. $31,329.82 above C. $32,780.33 D. $40,450.2 E. None of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts