Question: Problem #2 Guaranteed Residual Value Lease by a Third Party Sampson Leasing Incorporated entered into a lease with the Home Repair Corporation. The terms of

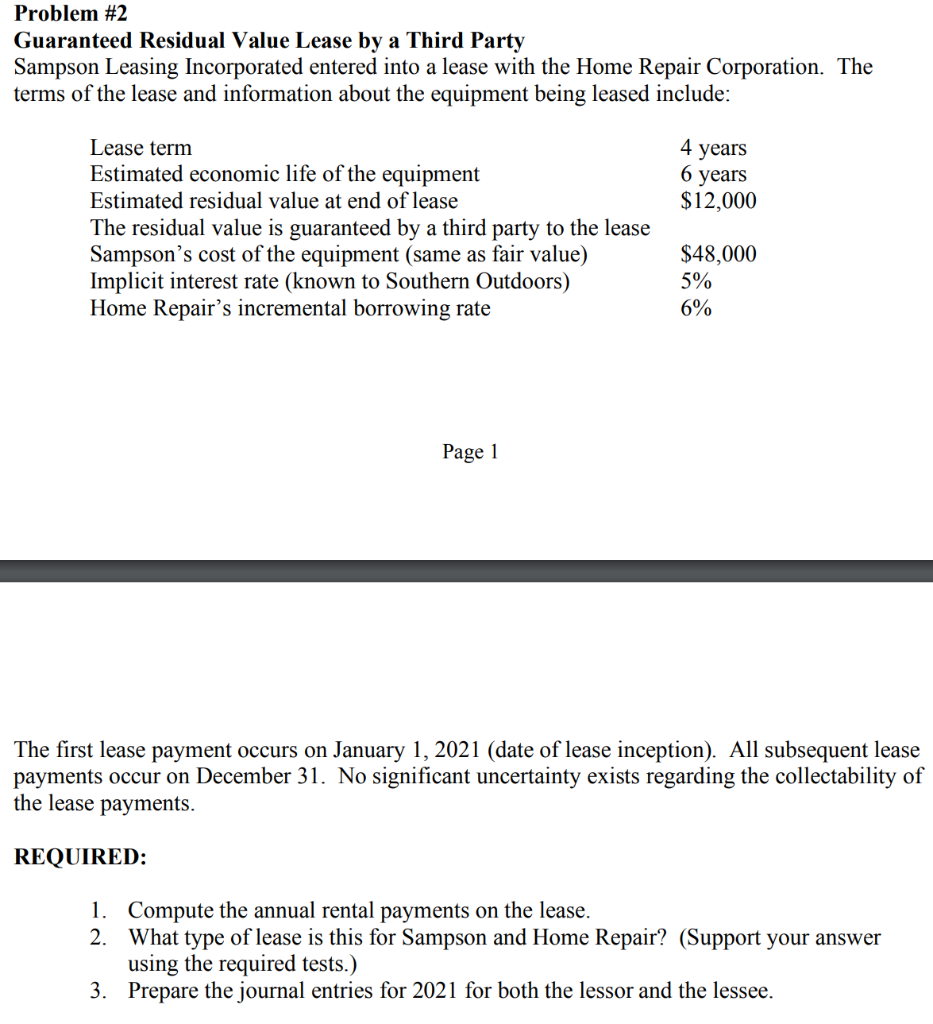

Problem #2 Guaranteed Residual Value Lease by a Third Party Sampson Leasing Incorporated entered into a lease with the Home Repair Corporation. The terms of the lease and information about the equipment being leased include: 4 years 6 years $12,000 Lease term Estimated economic life of the equipment Estimated residual value at end of lease The residual value is guaranteed by a third party to the lease Sampson's cost of the equipment (same as fair value) Implicit interest rate (known to Southern Outdoors) Home Repair's incremental borrowing rate $48,000 5% 6% Page 1 The first lease payment occurs on January 1, 2021 (date of lease inception). All subsequent lease payments occur on December 31. No significant uncertainty exists regarding the collectability of the lease payments. REQUIRED: 1. Compute the annual rental payments on the lease. 2. What type of lease is this for Sampson and Home Repair? (Support your answer using the required tests.) 3. Prepare the journal entries for 2021 for both the lessor and the lessee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts