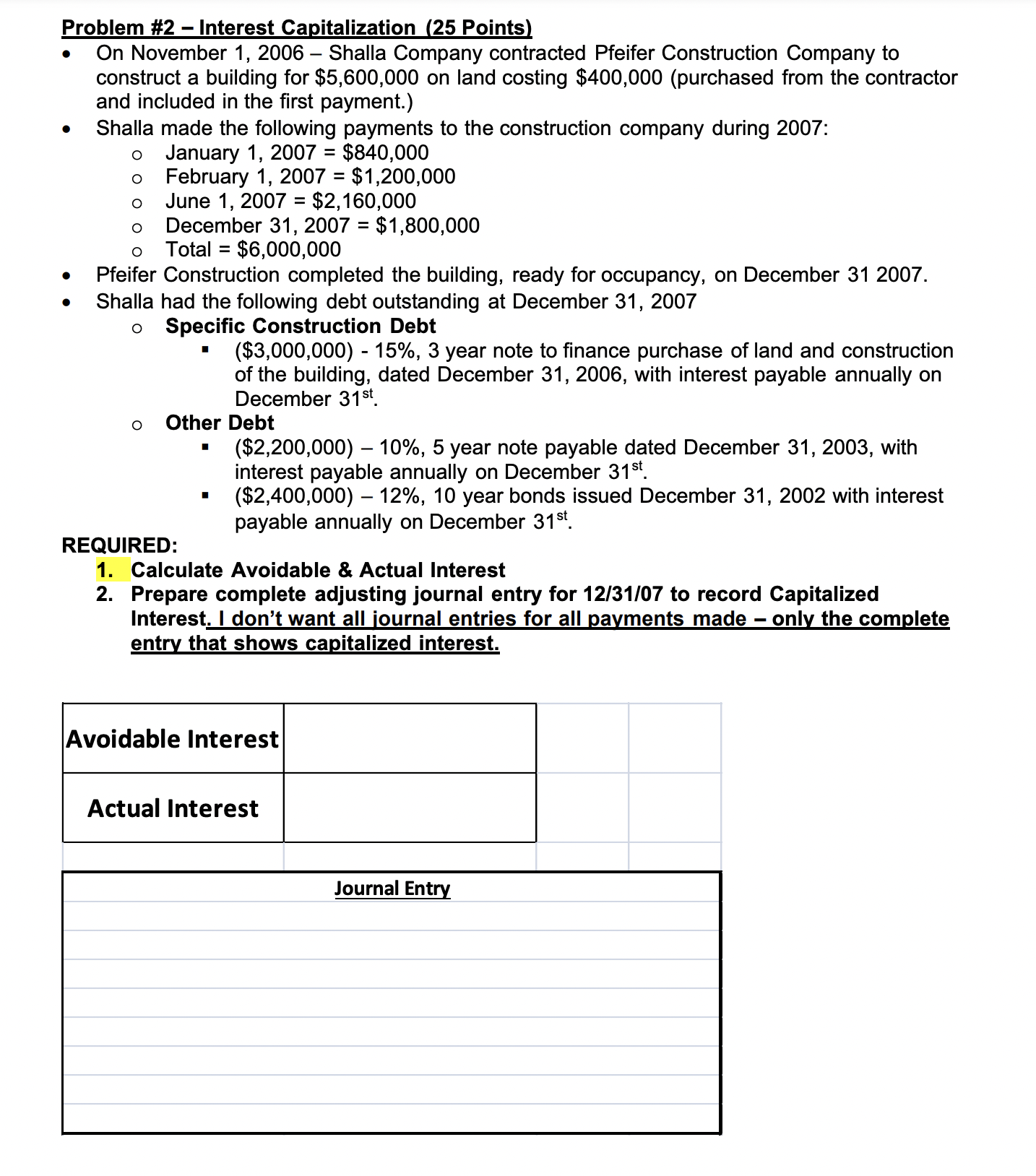

Question: Problem # 2 - Interest Capitalization ( 2 5 Points ) On November 1 , 2 0 0 6 - Shalla Company contracted Pfeifer Construction

Problem # Interest Capitalization Points

On November Shalla Company contracted Pfeifer Construction Company to

construct a building for $ on land costing $purchased from the contractor

and included in the first payment.

Shalla made the following payments to the construction company during :

January $

February $

June $

December $

Total $$ year note to finance purchase of land and construction

of the building, dated December with interest payable annually on

December st

Other Debt

$ year note payable dated December with

interest payable annually on December st

$ year bonds issued December with interest

payable annually on December st

REQUIRED:

Calculate Avoidable & Actual Interest

Prepare complete adjusting journal entry for to record Capitalized

Interest. I don't want all iournal entries for all payments made only the complete

entry that shows capitalized interest.

Journal Entry

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock