Question: Problem 2. Karmel Labs just purchased a photon-laser microscope. The company will make twelve $5,000 interest rate in this transaction is 8.4% compounded monthly. a)

Problem 2. Karmel Labs just purchased a photon-laser microscope. The company will make twelve

$5,000interest rate in this transaction is

8.4%compounded monthly.\ a) What is the appropriate annuity discount factor (Annuity Present Value Factor) here? (10 points).\ b) If Karmel's CEO, Stephanie Johnson, wants to buy the equipment today in one lump-sum payment, how much money will she need? As in Part (a), the interest rate is

8.4%compounded monthly. (15 points).\ c) Exactly 10 years ago, you started equal end-of-the month deposits into a savings account so that you could buy the microscope today in one lump-sum payment. How much did you deposit monthly to achieve this? As in parts (a) and (b), the interest rate is

8.4%compounded monthly. (15 points).

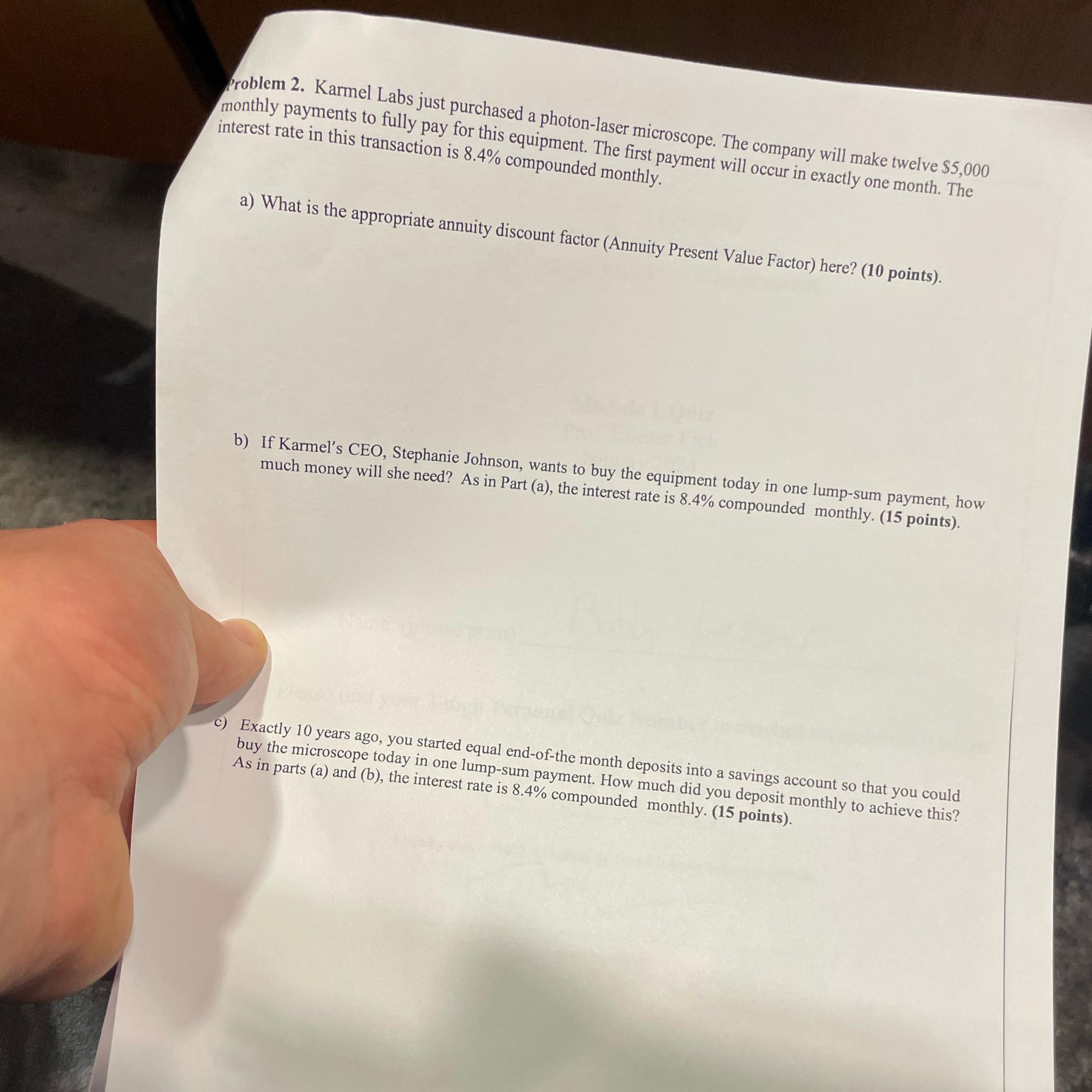

Problem 2. Karmel Labs just purchased a photon-laser microscope. The company will make twelve $5,000 monthly payments to fully pay for this equipment. The first payment will occur in exactly one month. The interest rate in this transaction is 8.4% compounded monthly. a) What is the appropriate annuity discount factor (Annuity Present Value Factor) here? (10 points). b) If Karmel's CEO, Stephanie Johnson, wants to buy the equipment today in one lump-sum payment, how much money will she need? As in Part (a), the interest rate is 8.4% compounded monthly. (15 points). c) Exactly 10 years ago, you started equal end-of-the month deposits into a savings account so that you could buy the microscope today in one lump-sum payment. How much did you deposit monthly to achieve this? As in parts (a) and (b), the interest rate is 8.4% compounded monthly. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts