Question: Problem #2: Listed below are transactions for J. Fraser Electronics. Required: Indicate the impact each transaction (in dollars and +/-) and any subsequent adjustments required

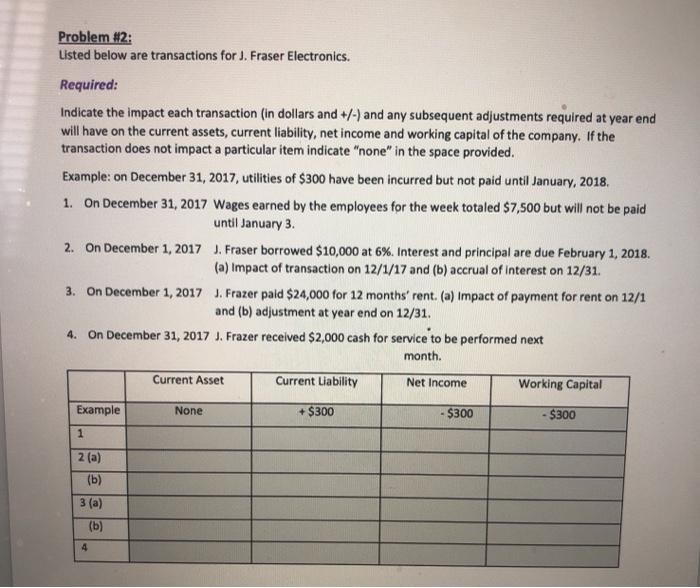

Problem #2: Listed below are transactions for J. Fraser Electronics. Required: Indicate the impact each transaction (in dollars and +/-) and any subsequent adjustments required at year end will have on the current assets, current liability, net income and working capital of the company. If the transaction does not impact a particular item indicate "none" in the space provided. Example: on December 31, 2017, utilities of $300 have been incurred but not paid until January, 2018 1. On December 31, 2017 Wages earned by the employees for the week totaled $7,500 but will not be paid until January 3. 2. On December 1, 2017 J. Fraser borrowed $10,000 at 6%. Interest and principal are due February 1, 2018. (a) Impact of transaction on 12/1/17 and (b) accrual of Interest on 12/31 3. On December 1, 2017 J. Frazer paid $24,000 for 12 months' rent. (a) Impact of payment for rent on 12/1 and (b) adjustment at year end on 12/31. 4. On December 31, 2017 J. Frazer received $2,000 cash for service to be performed next month. Current Asset Current Liability Net Income Working Capital Example None + $300 - $300 - $300 1 2 (a) (b) 3 (a) (b) 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts