Question: Problem #2 (long question) Five years ago, a young couple (Stevens alumni) bought a starter home in Hoboken, NJ at $600,000 with a down payment

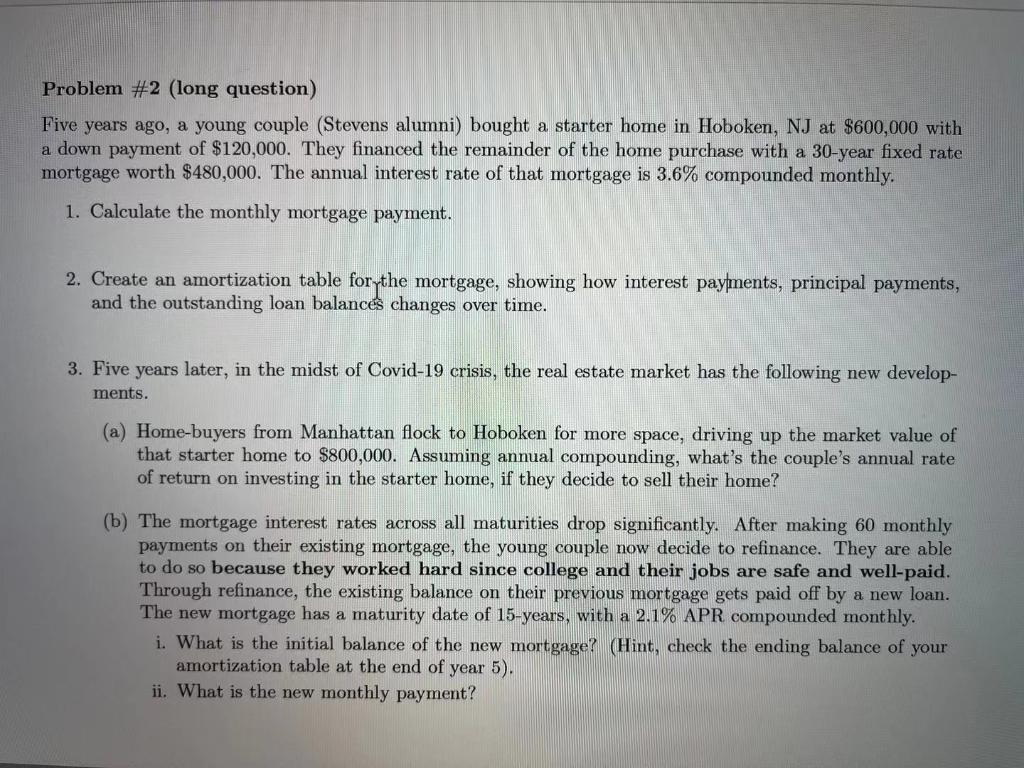

Problem #2 (long question) Five years ago, a young couple (Stevens alumni) bought a starter home in Hoboken, NJ at $600,000 with a down payment of $120,000. They financed the remainder of the home purchase with a 30-year fixed rate mortgage worth $480,000. The annual interest rate of that mortgage is 3.6% compounded monthly. 1. Calculate the monthly mortgage payment. 2. Create an amortization table forythe mortgage, showing how interest payments, principal payments, and the outstanding loan balances changes over time. 3. Five years later, in the midst of Covid-19 crisis, the real estate market has the following new develop- ments. (a) Home-buyers from Manhattan flock to Hoboken for more space, driving up the market value of that starter home to $800,000. Assuming annual compounding, what's the couple's annual rate of return on investing in the starter home, if they decide to sell their home? (b) The mortgage interest rates across all maturities drop significantly. After making 60 monthly payments on their existing mortgage, the young couple now decide to refinance. They are able to do so because they worked hard since college and their jobs are safe and well-paid. Through refinance, the existing balance on their previous mortgage gets paid off by a new loan. The new mortgage has a maturity date of 15-years, with a 2.1% APR compounded monthly. i. What is the initial balance of the new mortgage? (Hint, check the ending balance of your amortization table at the end of year 5). ii. What is the new monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts