Question: Problem 2 margin (Ch 3l Suppose you have $10,000 cash in your margin account, and you place a market order to buy 200 shares of

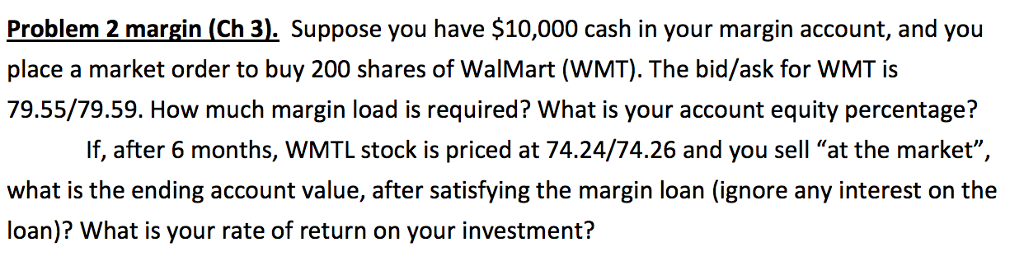

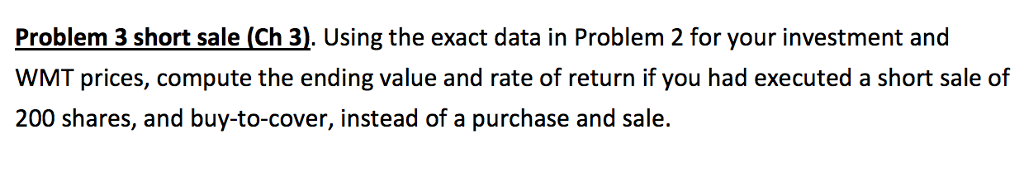

Problem 2 margin (Ch 3l Suppose you have $10,000 cash in your margin account, and you place a market order to buy 200 shares of WalMart (WMT). The bid/ask for WMT is 79.55/79.59. How much margin load is required? What is your account equity percentage? If, after 6 months, WMTL stock is priced at 74.24/74.26 and you sell "at the market", what is the ending account value, after satisfying the margin loan (ignore any interest on the loan)? What is your rate of return on your investment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock