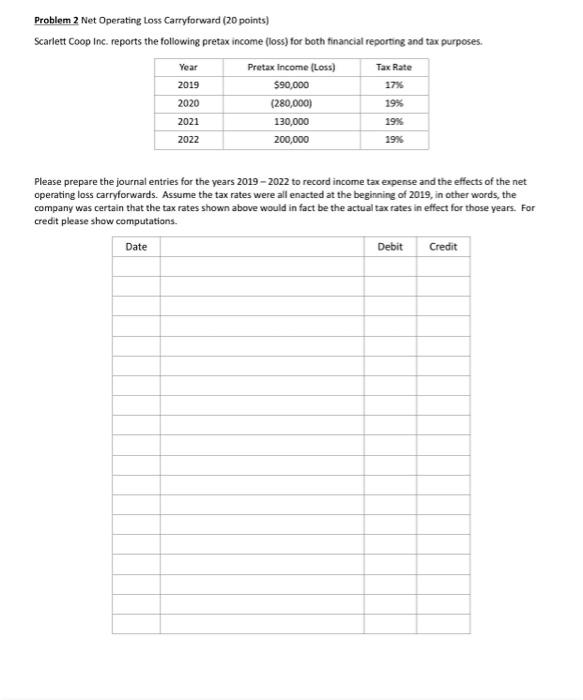

Question: Problem 2 Net Operating Loss Carryforward (20 points) Scarlett Coop Inc. reports the following pretax income (loss) for both financial reporting and tax purposes. Year

Problem 2 Net Operating Loss Carryforward (20 points) Scarlett Coop Inc. reports the following pretax income (loss) for both financial reporting and tax purposes. Year Pretax income (Loss) Tax Rate 2019 590,000 17% (280,000) 130,000 2022 200,000 19% 19% 2020 2021 19% Please prepare the journal entries for the years 2019-2022 to record income tax expense and the effects of the net operating loss carryforwards. Assume the tax rates were all enacted at the beginning of 2019, in other words, the company was certain that the tax rates shown above would in fact be the actual tax rates in effect for those years. For credit please show computations. Date Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts