Question: Problem 2 - NOTES PAYABLE Vinyl Resting Place ( a local records store ) issued a note to Bonnie Tiler on March 1 , 2

Problem NOTES PAYABLE

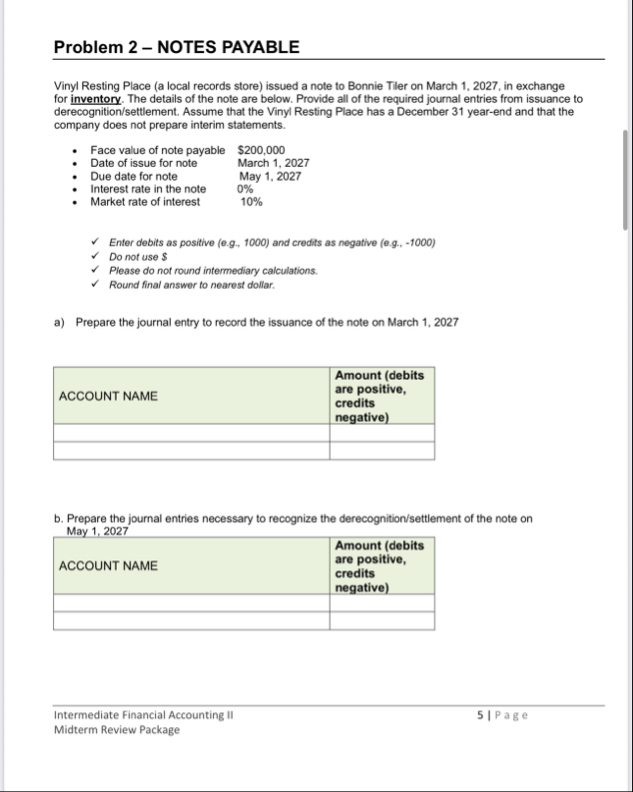

Vinyl Resting Place a local records store issued a note to Bonnie Tiler on March in exchange for inventory. The details of the note are below. Provide all of the required journal entries from issuance to derecognitionsettlement Assume that the Vinyl Resting Place has a December yearend and that the company does not prepare interim statements.

Face value of note payable

Date of issue for note

Due date for note

Interest rate in the note

Market rate of interest

$

March

May

Enter debits as positive eg and credits as negative eg

Do not use $

Please do not round intermediary calculations.

Round final answer to nearest dollar.

a Prepare the journal entry to record the issuance of the note on March

tableACCOUNT NAME,tableAmount debitsare positive,creditsnegative

b Prepare the journal entries necessary to recognize the derecognitionsettlement of the note on May

tableACCOUNT NAME,tableAmount debitsare positive,creditsnegative

Intermediate Financial Accounting II

Page

Midterm Review Package

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock