Question: Problem 2: Oil Forwards (5 points) A risk-free bond with face value of $1000 expiring one year from today can be bought or sold for

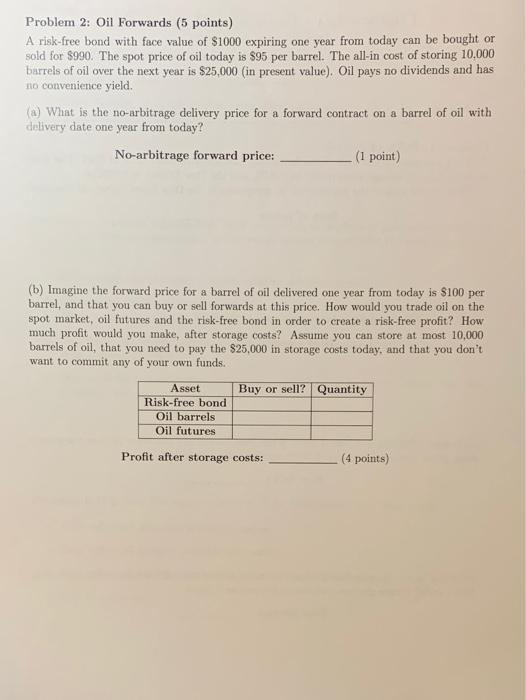

Problem 2: Oil Forwards (5 points) A risk-free bond with face value of $1000 expiring one year from today can be bought or sold for $990. The spot price of oil today is $95 per barrel. The all-in cost of storing 10.000 barrels of oil over the next year is $25,000 (in present value). Oil pays no dividends and has no convenience yield. (a) What is the no-arbitrage delivery price for a forward contract on a barrel of oil with delivery date one year from today? No-arbitrage forward price: (1 point) (b) Imagine the forward price for a barrel of oil delivered one year from today is $100 per barrel, and that you can buy or sell forwards at this price. How would you trade oil on the spot market, oil futures and the risk-free bond in order to create a risk-free profit? How much profit would you make, after storage costs? Assume you can store at most 10,000 barrels of oil, that you need to pay the $25,000 in storage costs today, and that you don't want to commit any of your own funds. Buy or sell? Quantity Risk-free bond Oil barrels Oil futures Asset Profit after storage costs: (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts