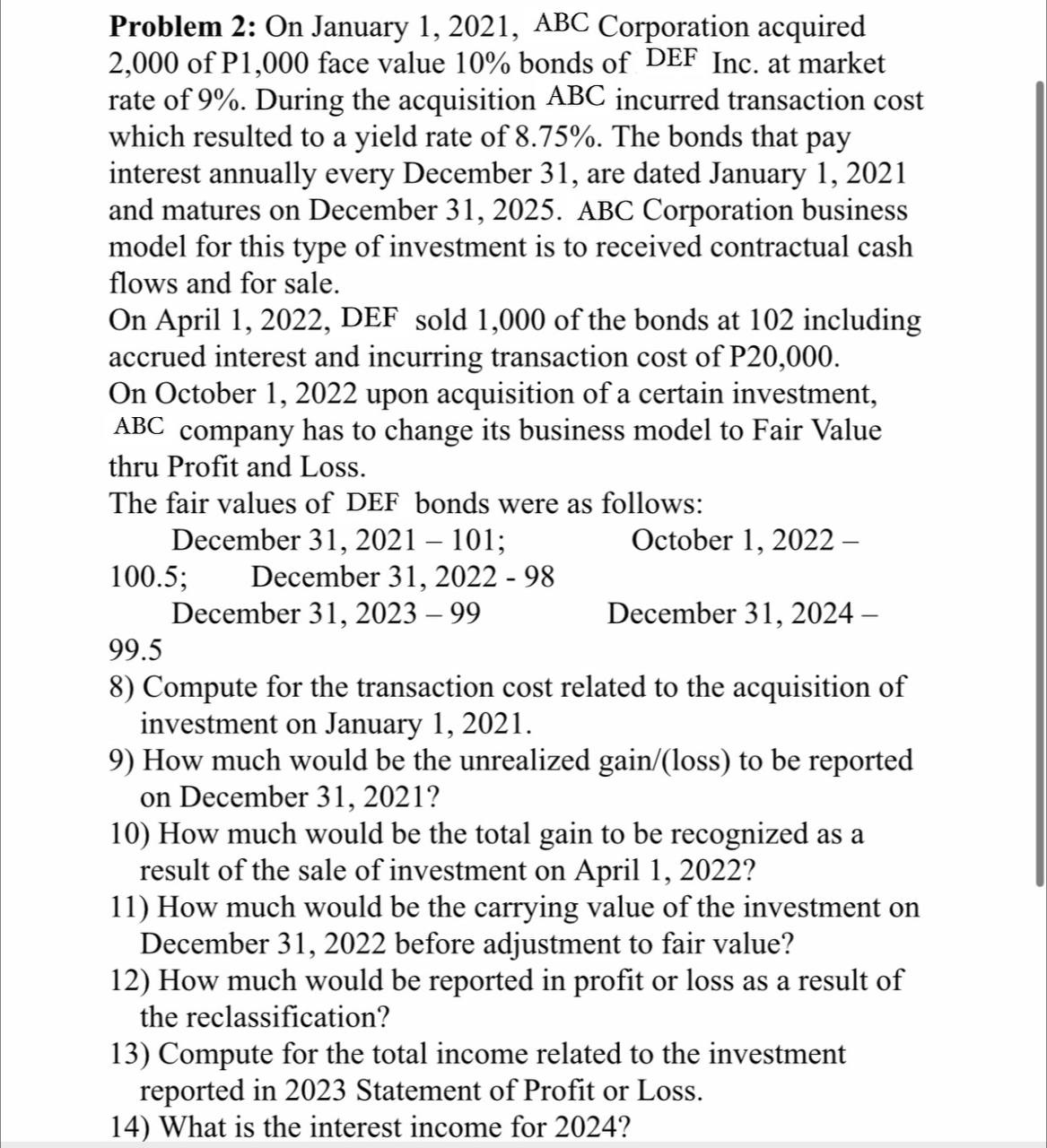

Question: Problem 2 : On January 1 , 2 0 2 1 , ABC Corporation acquired 2 , 0 0 0 of P 1 , 0

Problem : On January ABC Corporation acquired

of face value bonds of DEF Inc. at market

rate of During the acquisition ABC incurred transaction cost

which resulted to a yield rate of The bonds that pay

interest annually every December are dated January

and matures on December ABC Corporation business

model for this type of investment is to received contractual cash

flows and for sale.

On April DEF sold of the bonds at including

accrued interest and incurring transaction cost of P

On October upon acquisition of a certain investment,

ABC company has to change its business model to Fair Value

thru Profit and Loss.

The fair values of DEF bonds were as follows:

December ;

October

; December

December December

Compute for the transaction cost related to the acquisition of

investment on January

How much would be the unrealized gainloss to be reported

on December

How much would be the total gain to be recognized as a

result of the sale of investment on April

How much would be the carrying value of the investment on

December before adjustment to fair value?

How much would be reported in profit or loss as a result of

the reclassification?

Compute for the total income related to the investment

reported in Statement of Profit or Loss.

What is the interest income for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock