Question: Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044. This bond has a par value of S100

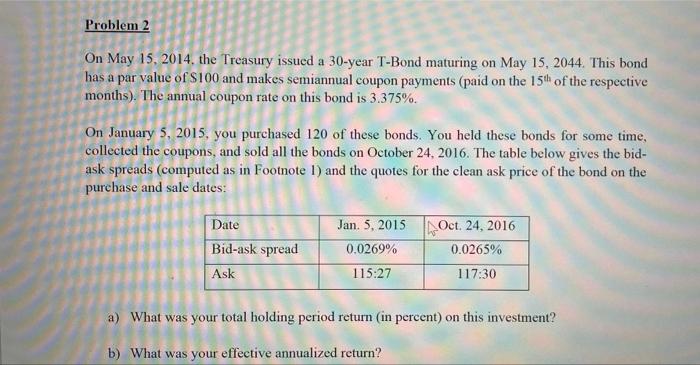

Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044. This bond has a par value of S100 and makes semiannual coupon payments (paid on the 15th of the respective months). The annual coupon rate on this bond is 3.375%. On January 5, 2015, you purchased 120 of these bonds. You held these bonds for some time, collected the coupons, and sold all the bonds on October 24, 2016. The table below gives the bid- ask spreads (computed as in Footnote 1) and the quotes for the clean ask price of the bond on the purchase and sale dates: Date Bid-ask spread Jan. 5, 2015 Oct. 24, 2016 0.0269% 0.0265% 115:27 117:30 Ask a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized return? Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044. This bond has a par value of S100 and makes semiannual coupon payments (paid on the 15th of the respective months). The annual coupon rate on this bond is 3.375%. On January 5, 2015, you purchased 120 of these bonds. You held these bonds for some time, collected the coupons, and sold all the bonds on October 24, 2016. The table below gives the bid- ask spreads (computed as in Footnote 1) and the quotes for the clean ask price of the bond on the purchase and sale dates: Date Bid-ask spread Jan. 5, 2015 Oct. 24, 2016 0.0269% 0.0265% 115:27 117:30 Ask a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts