Question: Problem 2 only please 1. (10 points) Suppose you observe the semi-annually compounded spot rate curve to- day (See, the excel file). Compute the duration

Problem 2 only please

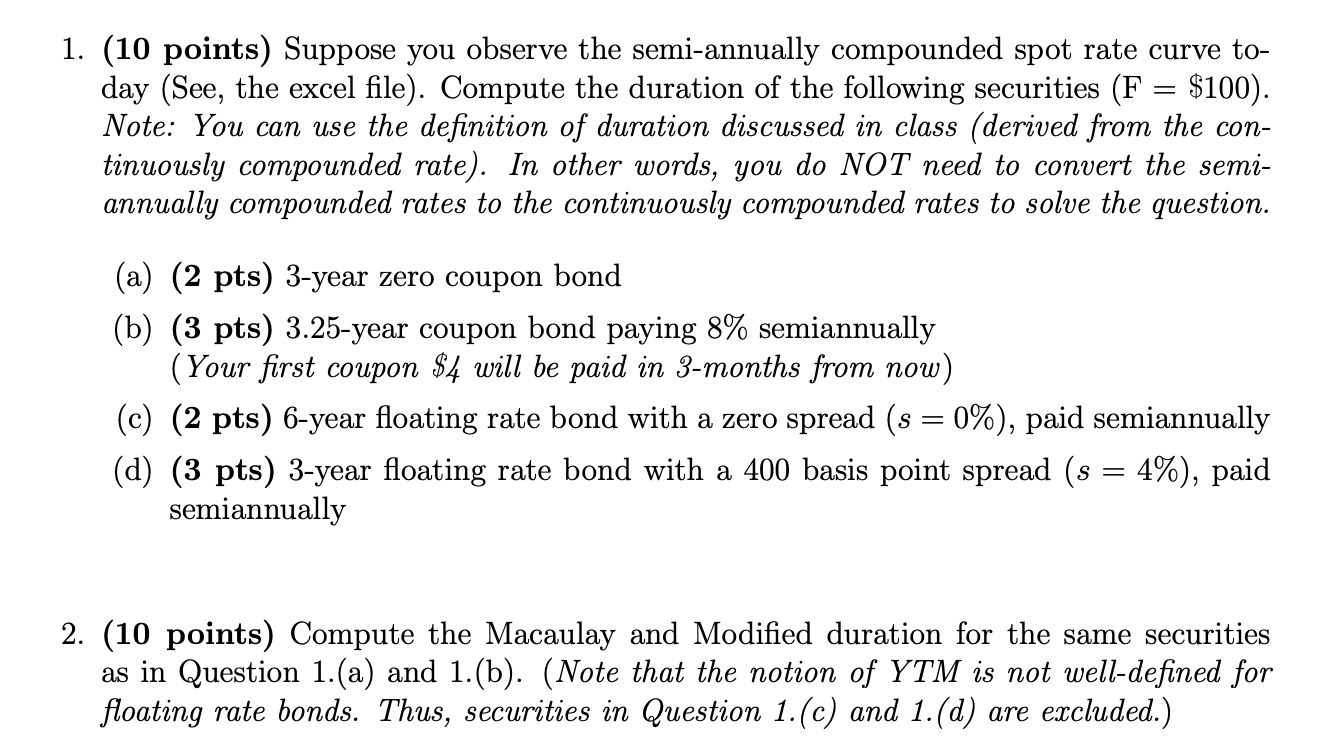

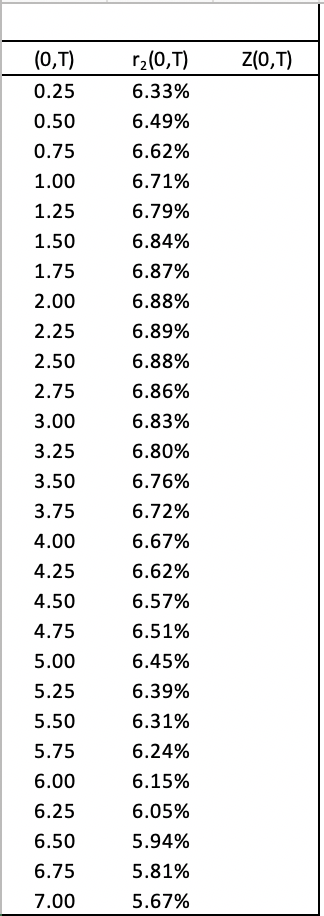

1. (10 points) Suppose you observe the semi-annually compounded spot rate curve to- day (See, the excel file). Compute the duration of the following securities (F = $100). Note: You can use the definition of duration discussed in class (derived from the con- tinuously compounded rate). In other words, you do NOT need to convert the semi- annually compounded rates to the continuously compounded rates to solve the question. (a) (2 pts) 3-year zero coupon bond (b) (3 pts) 3.25-year coupon bond paying 8% semiannually (Your first coupon $4 will be paid in 3-months from now) (c) (2 pts) 6-year floating rate bond with a zero spread (s = 0%), paid semiannually (d) (3 pts) 3-year floating rate bond with a 400 basis point spread (s = 4%), paid semiannually 2. (10 points) Compute the Macaulay and Modified duration for the same securities as in Question 1.(a) and 1.(b). (Note that the notion of YTM is not well-defined for floating rate bonds. Thus, securities in Question 1.(c) and 1.(d) are excluded.) Z(0,T) r2(0,T) 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 6.86% 6.83% 6.80% (0,T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67% 1. (10 points) Suppose you observe the semi-annually compounded spot rate curve to- day (See, the excel file). Compute the duration of the following securities (F = $100). Note: You can use the definition of duration discussed in class (derived from the con- tinuously compounded rate). In other words, you do NOT need to convert the semi- annually compounded rates to the continuously compounded rates to solve the question. (a) (2 pts) 3-year zero coupon bond (b) (3 pts) 3.25-year coupon bond paying 8% semiannually (Your first coupon $4 will be paid in 3-months from now) (c) (2 pts) 6-year floating rate bond with a zero spread (s = 0%), paid semiannually (d) (3 pts) 3-year floating rate bond with a 400 basis point spread (s = 4%), paid semiannually 2. (10 points) Compute the Macaulay and Modified duration for the same securities as in Question 1.(a) and 1.(b). (Note that the notion of YTM is not well-defined for floating rate bonds. Thus, securities in Question 1.(c) and 1.(d) are excluded.) Z(0,T) r2(0,T) 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 6.86% 6.83% 6.80% (0,T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts