Question: Problem #2 Over the past five years, a stock produced returns of 12%, -2%, 14%, 6%, and 18%. What is the probability that an investor

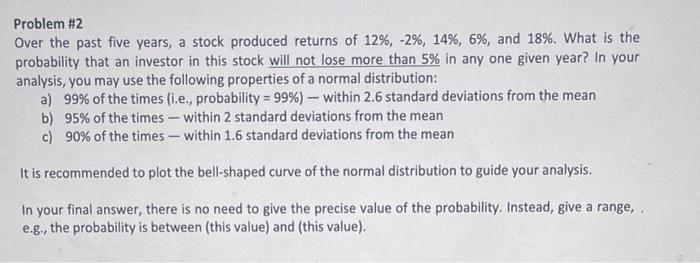

Problem #2 Over the past five years, a stock produced returns of 12%, -2%, 14%, 6%, and 18%. What is the probability that an investor in this stock will not lose more than 5% in any one given year? In your analysis, you may use the following properties of a normal distribution: a) 99% of the times (.e., probability = 99%) - within 2.6 standard deviations from the mean b) 95% of the times - within 2 standard deviations from the mean c) 90% of the times --- within 1.6 standard deviations from the mean It is recommended to plot the bell-shaped curve of the normal distribution to guide your analysis. In your final answer, there is no need to give the precise value of the probability. Instead, give a range, e.g., the probability is between (this value) and (this value). Problem #2 Over the past five years, a stock produced returns of 12%, -2%, 14%, 6%, and 18%. What is the probability that an investor in this stock will not lose more than 5% in any one given year? In your analysis, you may use the following properties of a normal distribution: a) 99% of the times (.e., probability = 99%) - within 2.6 standard deviations from the mean b) 95% of the times - within 2 standard deviations from the mean c) 90% of the times --- within 1.6 standard deviations from the mean It is recommended to plot the bell-shaped curve of the normal distribution to guide your analysis. In your final answer, there is no need to give the precise value of the probability. Instead, give a range, e.g., the probability is between (this value) and (this value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts