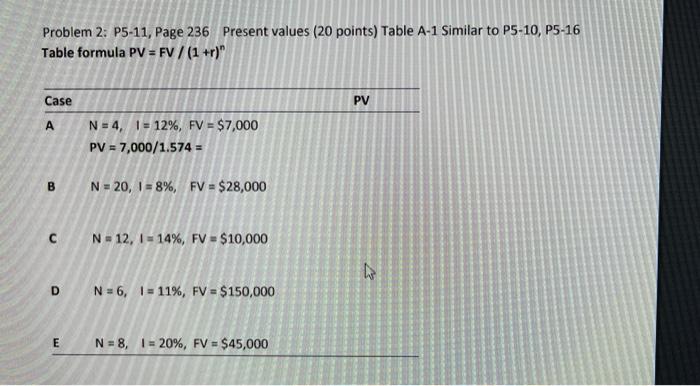

Question: Problem 2: P5-11, Page 236 Present values (20 points) Table A-1 Similar to P5-10, P5-16 Table formula PV = FV / (1+r) Case PV N

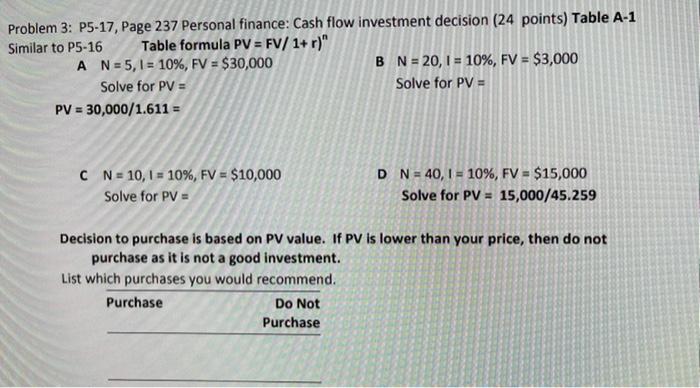

Problem 2: P5-11, Page 236 Present values (20 points) Table A-1 Similar to P5-10, P5-16 Table formula PV = FV / (1+r)" Case PV N = 4, 1 = 12%, FV = $7,000 PV = 7,000/1.574 = B N = 20, 1 = 8%, FV = $28,000 C N = 12, I = 14%, FV = $10,000 to D N = 6, 1 = 11%, FV = $150,000 E N = 8, 1 = 20%, FV = $45,000 Problem 3: P5-17, Page 237 Personal finance: Cash flow investment decision (24 points) Table A-1 Similar to P5-16 Table formula PV = FV/ 1+r)" A N = 5,1 = 10%, FV = $30,000 B N = 20, 1 = 10%, FV = $3,000 Solve for PV = Solve for PV = PV = 30,000/1.611 = C N = 10,1 = 10%, FV = $10,000 Solve for PV = DN = 40, 1 = 10%, FV = $15,000 Solve for PV = 15,000/45.259 Decision to purchase is based on PV value. If PV is lower than your price, then do not purchase as it is not a good investment. List which purchases you would recommend. Purchase Do Not Purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts