Question: Problem 2: Philippine Telecom is considering a project for the coming year that will cost P250 million. Philippine Telecom plans to use the following combination

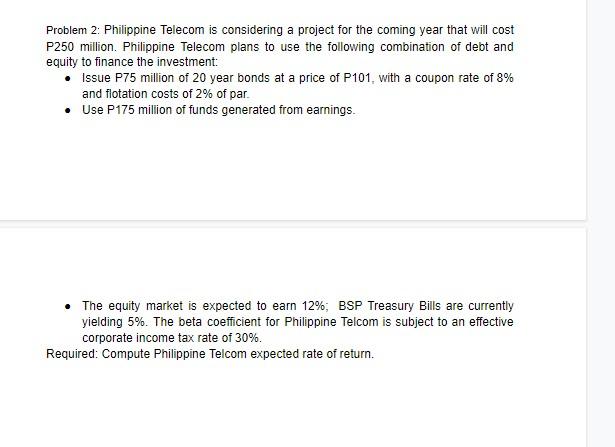

Problem 2: Philippine Telecom is considering a project for the coming year that will cost P250 million. Philippine Telecom plans to use the following combination of debt and equity to finance the investment: Issue P75 million of 20 year bonds at a price of P101, with a coupon rate of 8% and flotation costs of 2% of par Use P175 million of funds generated from earnings. The equity market is expected to earn 12%; BSP Treasury Bills are currently yielding 5%. The beta coefficient for Philippine Telcom is subject to an effective corporate income tax rate of 30%. Required: Compute Philippine Telcom expected rate of return. Problem 2: Philippine Telecom is considering a project for the coming year that will cost P250 million. Philippine Telecom plans to use the following combination of debt and equity to finance the investment: Issue P75 million of 20 year bonds at a price of P101, with a coupon rate of 8% and flotation costs of 2% of par Use P175 million of funds generated from earnings. The equity market is expected to earn 12%; BSP Treasury Bills are currently yielding 5%. The beta coefficient for Philippine Telcom is subject to an effective corporate income tax rate of 30%. Required: Compute Philippine Telcom expected rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts