Question: PROBLEM 2 Pink Inc. manufactures Zen products from a process that yield a by-product called YAN. The by-product requires additional processing cost of P30,000.

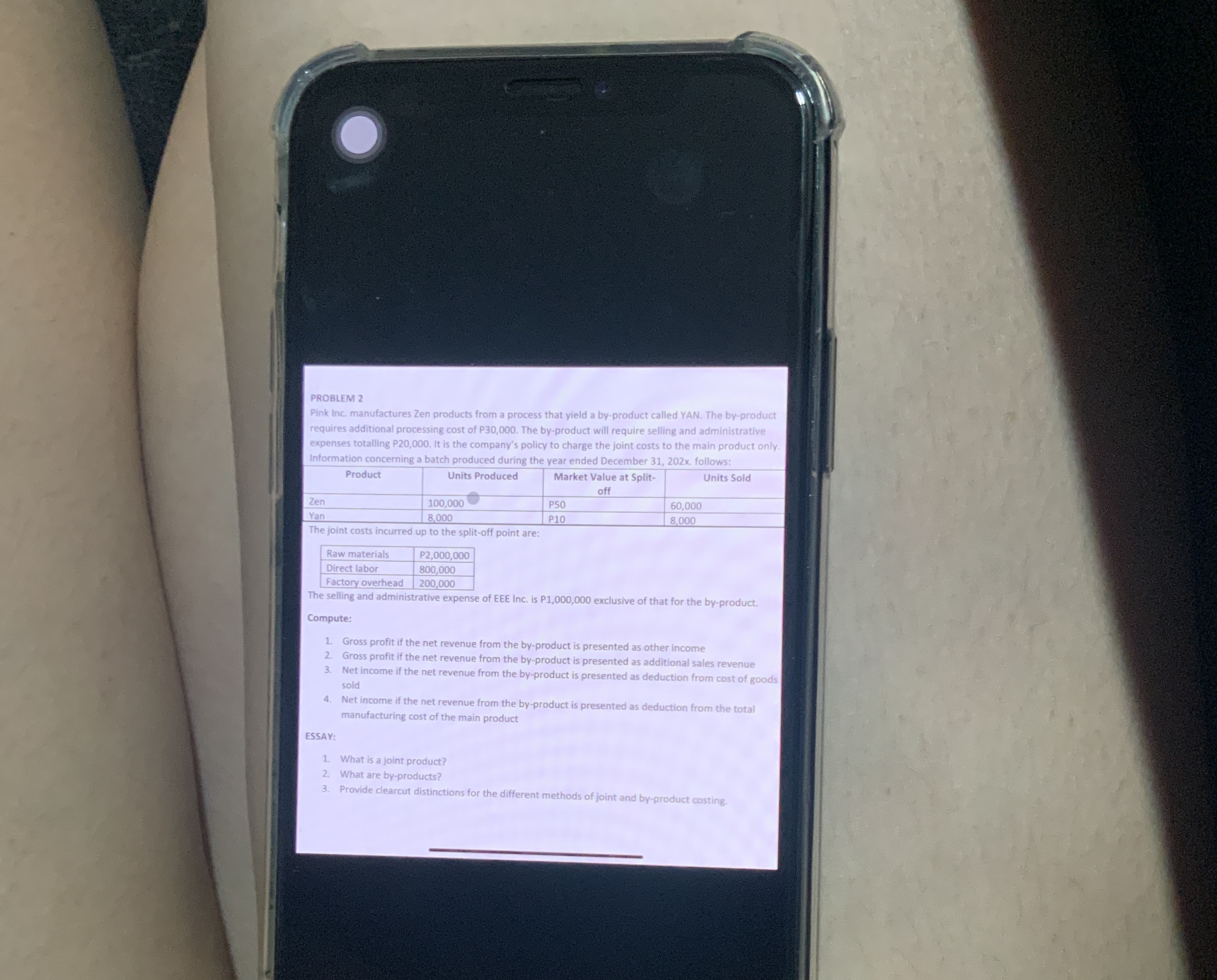

PROBLEM 2 Pink Inc. manufactures Zen products from a process that yield a by-product called YAN. The by-product requires additional processing cost of P30,000. The by-product will require selling and administrative expenses totalling P20,000. It is the company's policy to charge the joint costs to the main product only. Information concerning a batch produced during the year ended December 31, 202x. follows: Product Zen Yan Units Produced 100,000 8,000 The joint costs incurred up to the split-off point are: Raw materials Direct labor P2,000,000 800,000 200,000 Market Value at Split- off Units Sold P50 P10 60,000 8,000 Factory overhead The selling and administrative expense of EEE Inc. is P1,000,000 exclusive of that for the by-product. Compute: 1. Gross profit if the net revenue from the by-product is presented as other income 2. Gross profit if the net revenue from the by-product is presented as additional sales revenue 3. Net income if the net revenue from the by-product is presented as deduction from cost of goods sold 4. Net income if the net revenue from the by-product is presented as deduction from the total manufacturing cost of the main product ESSAY: 1. What is a joint product? 2. What are by-products? 3. Provide clearcut distinctions for the different methods of joint and by-product costing.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts