Question: Problem # 2 : Please complete the Problem below and upload your answers in a excel document. Please male sure to show your work (

Problem #:

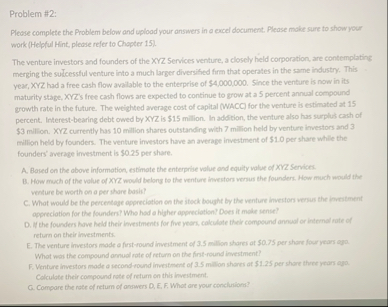

Please complete the Problem below and upload your answers in a excel document. Please male sure to show your work Helpful Hint, please refer to Chapter

The unnhure investors and founders of the XYZ ervices venture, a closely held corporation, are contiomplations merging the sulcessful venture into a much larger diversified firm that operates in the same industry. This year, XYZ had a free cash flow avalable to the enterprise of $ Since the venture is now in its maturity stage, XYZ s free cash flows are expected to continue to grow at a percent annual compound growth rate in the future. The wighted average cost of capital WACC for the venture is estimated at percent. inferestbearing debt owed by KYZ is $ milion. n derlon, the ventire alon hom sumbint each of $ milion. XYZ currently has million shares outstanding with million held by venture ievestors and million held by founders. The venture investors have an average investment of $ per share while the founders' average irvestment is $ per share.

A Blased on the above information, estimate the enterprise value and equity valur of XYZ Servicer.

B How much of the value of XYZ would belong to the venture investors versus the founders. How much would the venture be worth on a per ihare basia? appreciation for the founden? Whe had a hagher appecciation? Does it male sense?

D If the founders have held their isvestments for five years, colculate thel compound annual or intemal rate of reforn on their investments. Whot was the compound arnual rote of return on the firstround investment?

F Venture investors made a recond round investment of milion shares of $ per share three vears apa. Colculste their compound rote of relum on this investment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock