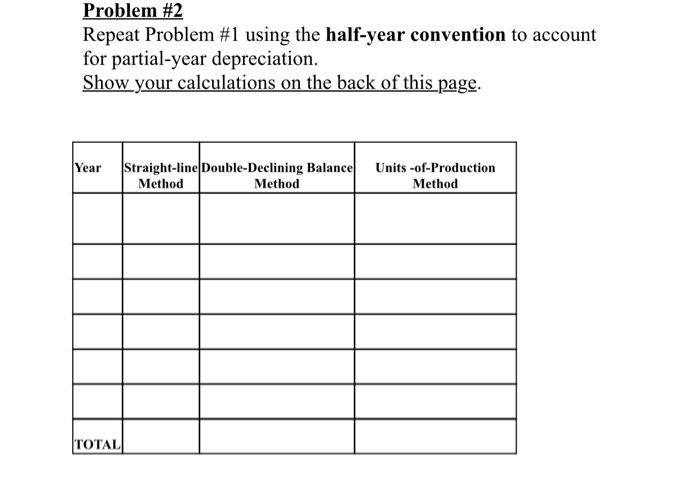

Question: Problem 2 Problem #2 Repeat Problem #1 using the half-year convention to account for partial-year depreciation. Show your calculations on the back of this page.

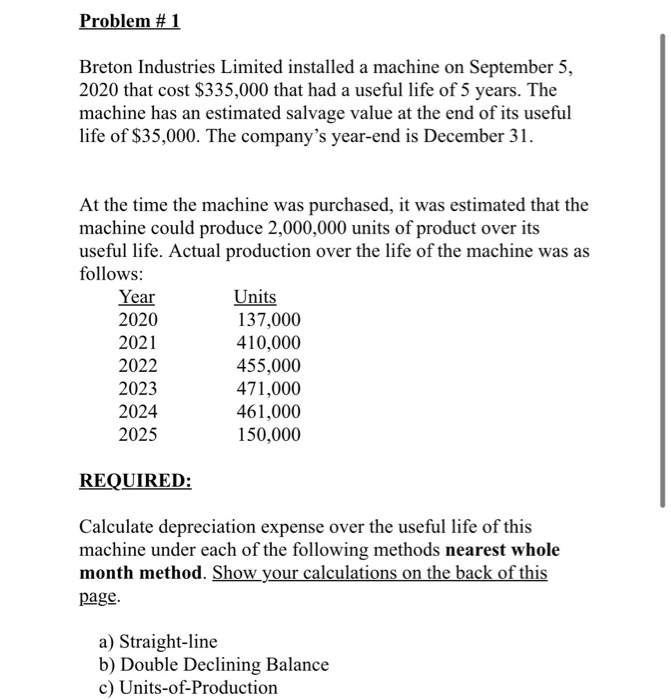

Problem #2 Repeat Problem #1 using the half-year convention to account for partial-year depreciation. Show your calculations on the back of this page. Year Straight-line Double-Declining Balancel Method Method Units -of-Production Method TOTAL Problem #1 Breton Industries Limited installed a machine on September 5, 2020 that cost $335,000 that had a useful life of 5 years. The machine has an estimated salvage value at the end of its useful life of $35,000. The company's year-end is December 31. At the time the machine was purchased, it was estimated that the machine could produce 2,000,000 units of product over its useful life. Actual production over the life of the machine was as follows: Year Units 2020 137,000 2021 410,000 2022 455,000 2023 471,000 2024 461,000 2025 150,000 REQUIRED: Calculate depreciation expense over the useful life of this machine under each of the following methods nearest whole month method. Show your calculations on the back of this page. a) Straight-line b) Double Declining Balance c) Units-of-Production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts