Question: PROBLEM 2 Problem: We follow MMI. This time there is risk also on debt. A firm has a debt/equity ratio of 0.6. a The company

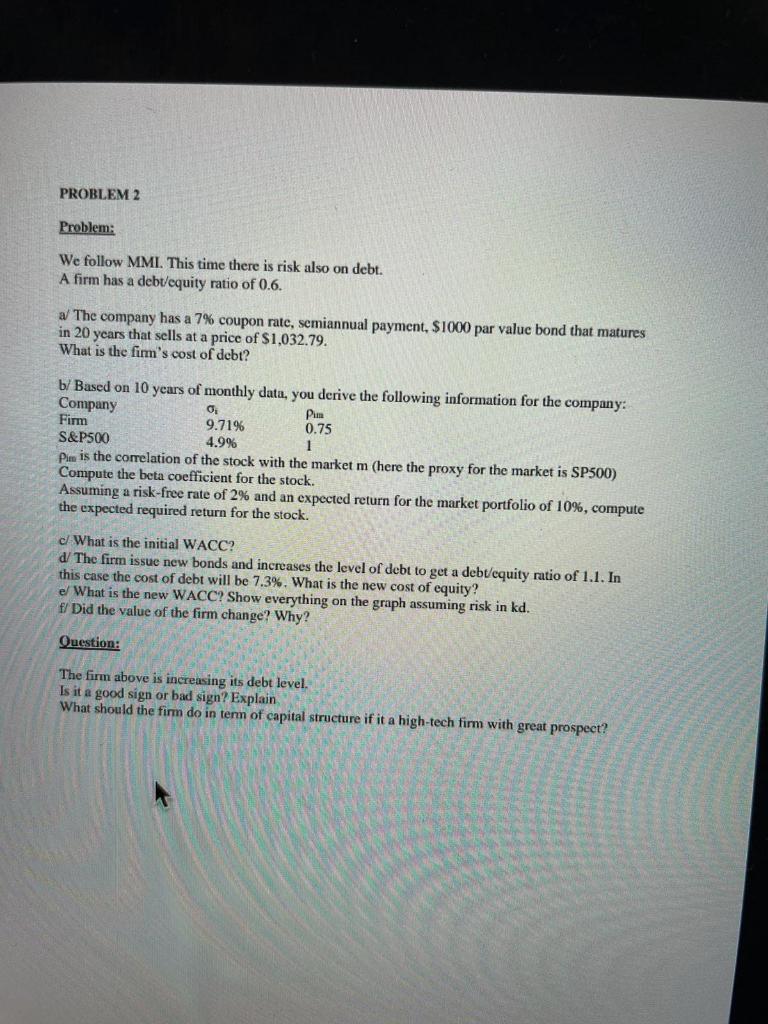

PROBLEM 2 Problem: We follow MMI. This time there is risk also on debt. A firm has a debt/equity ratio of 0.6. a The company has a 7% coupon rate, semiannual payment, $1000 par value bond that matures in 20 years that sells at a price of $1,032.79. What is the firm's cost of debt? b/ Based on 10 years of monthly data, you derive the following information for the company: Company Pim Firm 9.71% 0.75 S&P500 4.9% 1 Pue is the correlation of the stock with the market m (here the proxy for the market is SP500) Compute the beta coefficient for the stock. Assuming a risk-free rate of 2% and an expected return for the market portfolio of 10%, compute the expected required return for the stock. c/ What is the initial WACC? d The firm issue new bonds and increases the level of debt to get a debt/equity ratio of 1.1. In this case the cost of debt will be 7.3%. What is the new cost of equity? el What is the new WACC? Show everything on the graph assuming risk in kd. f/ Did the value of the firm change? Why? Question: The firm above is increasing its debt level. Is it a good sign or bad sign? Explain What should the firm do in term of capital structure if it a high-tech firm with great prospect? PROBLEM 2 Problem: We follow MMI. This time there is risk also on debt. A firm has a debt/equity ratio of 0.6. a The company has a 7% coupon rate, semiannual payment, $1000 par value bond that matures in 20 years that sells at a price of $1,032.79. What is the firm's cost of debt? b/ Based on 10 years of monthly data, you derive the following information for the company: Company Pim Firm 9.71% 0.75 S&P500 4.9% 1 Pue is the correlation of the stock with the market m (here the proxy for the market is SP500) Compute the beta coefficient for the stock. Assuming a risk-free rate of 2% and an expected return for the market portfolio of 10%, compute the expected required return for the stock. c/ What is the initial WACC? d The firm issue new bonds and increases the level of debt to get a debt/equity ratio of 1.1. In this case the cost of debt will be 7.3%. What is the new cost of equity? el What is the new WACC? Show everything on the graph assuming risk in kd. f/ Did the value of the firm change? Why? Question: The firm above is increasing its debt level. Is it a good sign or bad sign? Explain What should the firm do in term of capital structure if it a high-tech firm with great prospect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts