Question: Problem 2. PTECH Supply Co. (PTSC) is expected to begin dividend payments next fiscal year (ended May, 2023) by paying 51.50 per share. Over the

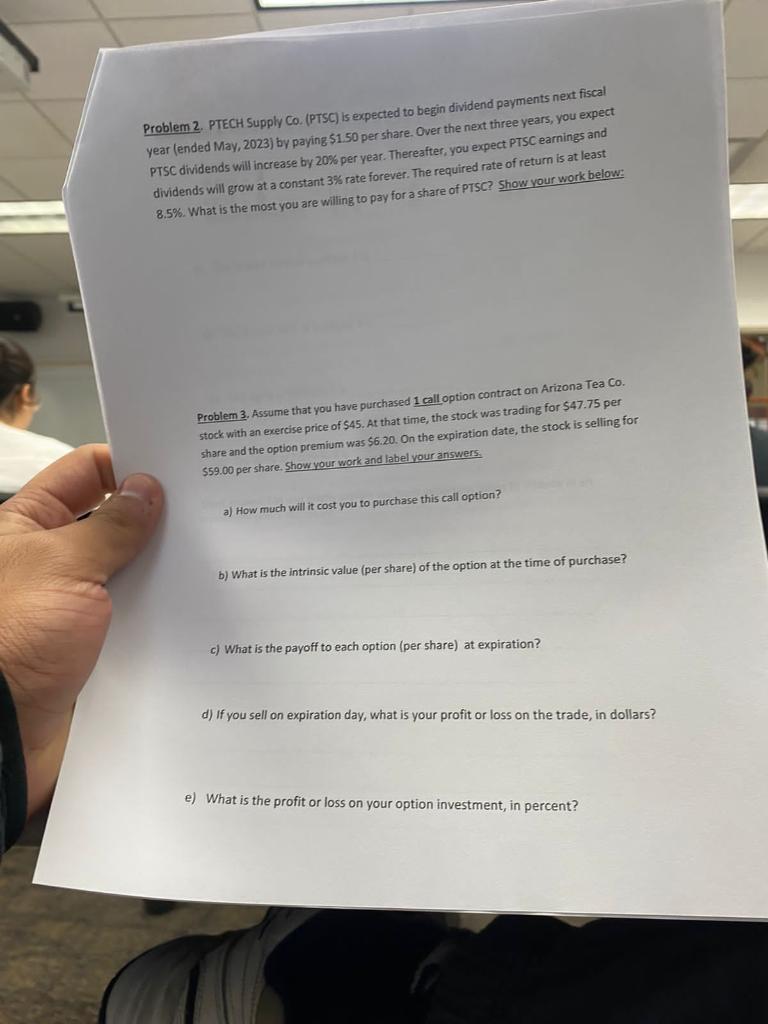

Problem 2. PTECH Supply Co. (PTSC) is expected to begin dividend payments next fiscal year (ended May, 2023) by paying 51.50 per share. Over the next three years, you expect PTSC dividends will increase by 20% per year. Thereafter, you expect PTSC earnings and dividends will grow at a constant 3% rate forever. The required rate of return is at least 8.5%. What is the most you are willing to pay for a share of PTSC? Show your work below: Problem 3. Assume that you have purchased 1 call option contract on Arizona Tea Co. stock with an exercise price of $45. At that time, the stock was trading for $47.75 per share and the option premium was $6.20. On the expiration date, the stock is selling for $59.00 per share. Show your work and label your answers. a) How much will it cost you to purchase this call option? b) What is the intrinsic value (per share) of the option at the time of purchase? c) What is the payoff to each option (per share) at expiration? d) If you sell on expiration day, what is your profit or loss on the trade, in dollars? e) What is the profit or loss on your option investment, in percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts