Question: Problem 2. Real Options. (14 points) A project with an up-front cost att 0 of $1,600 is being considered by NPC. The project's subsequent cash

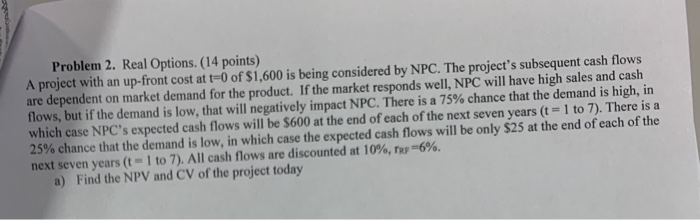

Problem 2. Real Options. (14 points) A project with an up-front cost att 0 of $1,600 is being considered by NPC. The project's subsequent cash flows are dependent on market demand for the product. If the market responds well, NPC will have high sales and cash flows, but if the demand is low, that will negatively impact NPC. There is a 75% chance that the demand is high, in which case NPC's expected cash flows will be $600 at the end of each of the next seven years (t = 1 to 7). There is a 25% chance that the demand is low, in which case the expected cash flows will be only $25 at the end of each of the next seven years ( 1 to 7). All cash flows are discounted at 10%, TR-6%. a) Find the NPV and CV of the project today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts