Question: Problem 2 (real options in shipping industries) . Because of the Asian Financial Crisis in 1997-1998, in March 1998, the price to ship 1

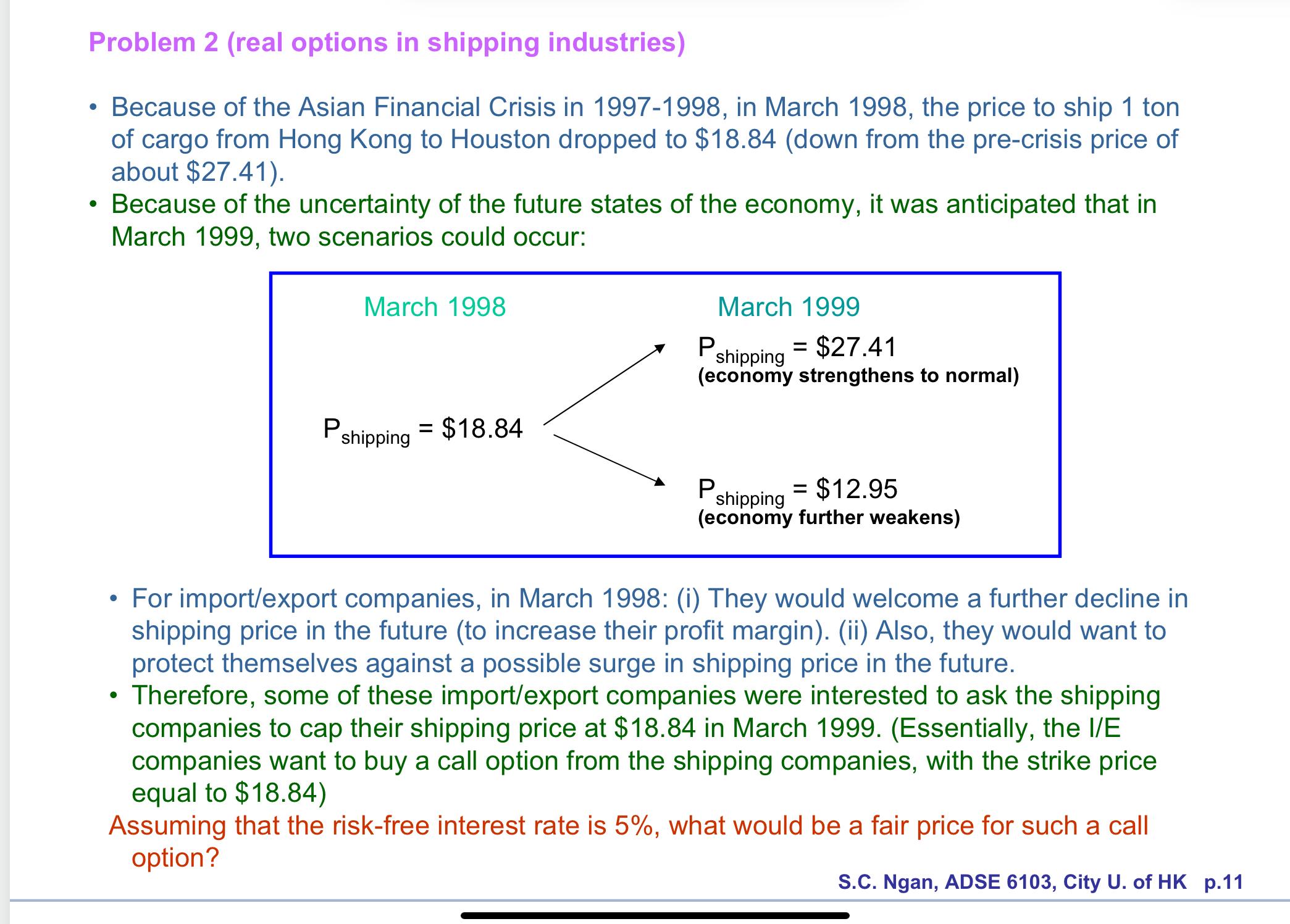

Problem 2 (real options in shipping industries) . Because of the Asian Financial Crisis in 1997-1998, in March 1998, the price to ship 1 ton of cargo from Hong Kong to Houston dropped to $18.84 (down from the pre-crisis price of about $27.41). Because of the uncertainty of the future states of the economy, it was anticipated that in March 1999, two scenarios could occur: March 1998 March 1999 P shipping = $27.41 (economy strengthens to normal) P shipping = $18.84 Pshipping = $12.95 (economy further weakens) For import/export companies, in March 1998: (i) They would welcome a further decline in shipping price in the future (to increase their profit margin). (ii) Also, they would want to protect themselves against a possible surge in shipping price in the future. Therefore, some of these import/export companies were interested to ask the shipping companies to cap their shipping price at $18.84 in March 1999. (Essentially, the I/E companies want to buy a call option from the shipping companies, with the strike price equal to $18.84) Assuming that the risk-free interest rate is 5%, what would be a fair price for such a call option? S.C. Ngan, ADSE 6103, City U. of HK p.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts