Question: Problem 2. Redo all the calculations in problem 1 assuming a semi-annual coupon payment. Problem 3. Complete the Table below for a 10-year zero coupon

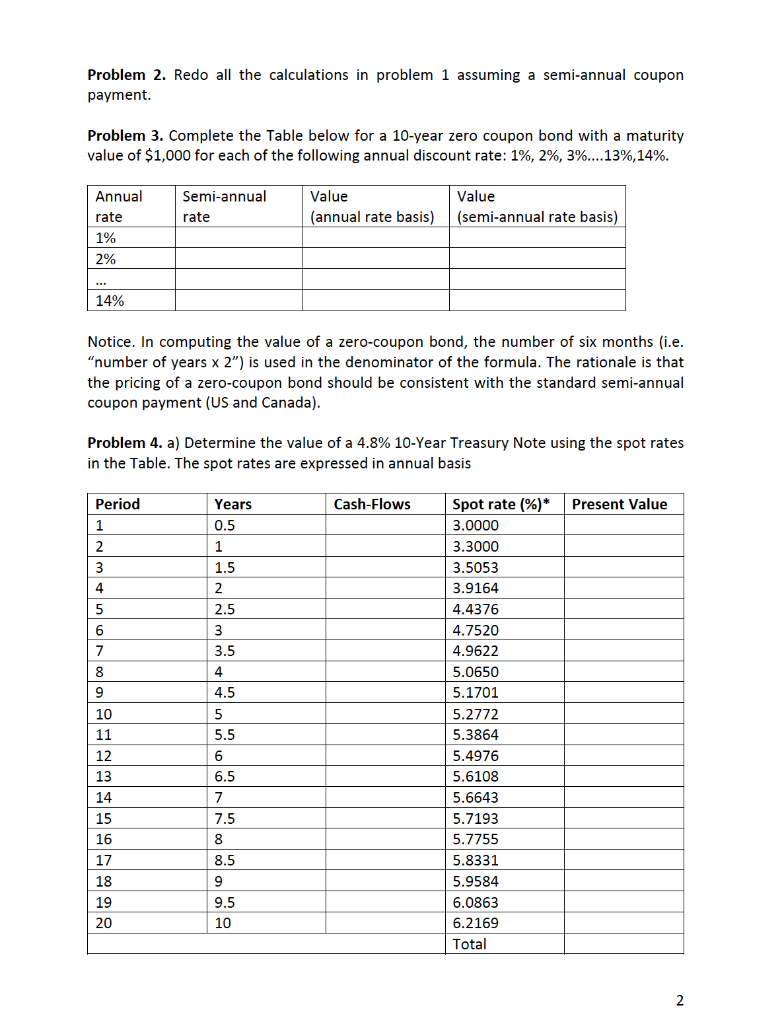

Problem 2. Redo all the calculations in problem 1 assuming a semi-annual coupon payment. Problem 3. Complete the Table below for a 10-year zero coupon bond with a maturity value of $1,000 for each of the following annual discount rate: 1%,2%,3%.13%,14%. Notice. In computing the value of a zero-coupon bond, the number of six months (i.e. "number of years 2 ") is used in the denominator of the formula. The rationale is that the pricing of a zero-coupon bond should be consistent with the standard semi-annual coupon payment (US and Canada). Problem 4. a) Determine the value of a 4.8%10-Year Treasury Note using the spot rates in the Table. The spot rates are expressed in annual basis Problem 2. Redo all the calculations in problem 1 assuming a semi-annual coupon payment. Problem 3. Complete the Table below for a 10-year zero coupon bond with a maturity value of $1,000 for each of the following annual discount rate: 1%,2%,3%.13%,14%. Notice. In computing the value of a zero-coupon bond, the number of six months (i.e. "number of years 2 ") is used in the denominator of the formula. The rationale is that the pricing of a zero-coupon bond should be consistent with the standard semi-annual coupon payment (US and Canada). Problem 4. a) Determine the value of a 4.8%10-Year Treasury Note using the spot rates in the Table. The spot rates are expressed in annual basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts