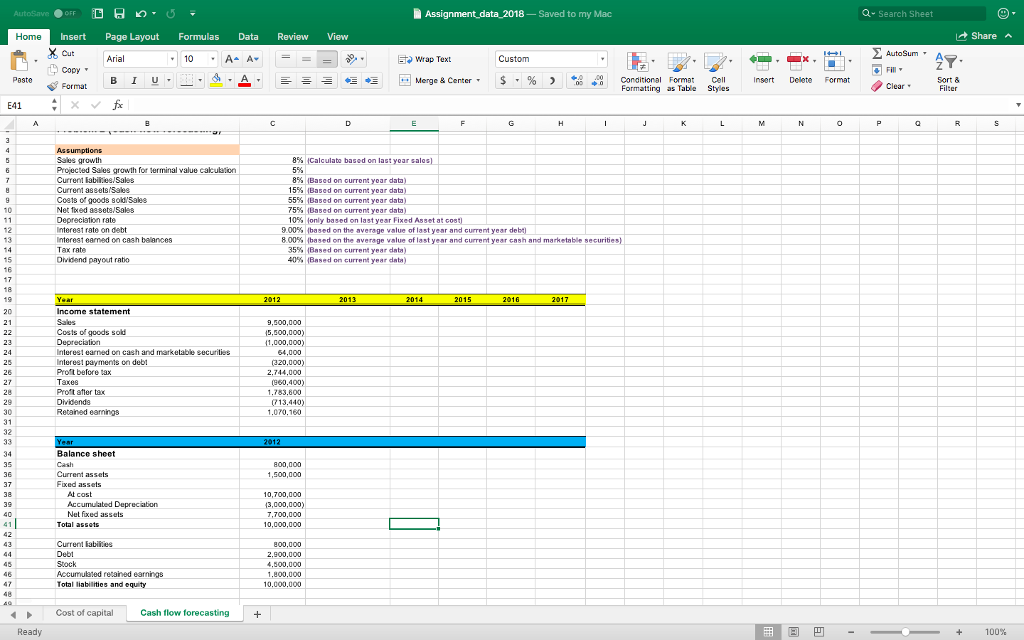

Question: Problem 2: Refer to worksheet Cash Flow Forecasting (13 + 5 + 4 + 3 = 25 Marks) Question 2.1 Using the assumptions, income statement

Problem 2: Refer to worksheet Cash Flow Forecasting (13 + 5 + 4 + 3 = 25 Marks)

Question 2.1

Using the assumptions, income statement (year 2012) and balance sheet (as of 2012) data, develop the forecasted balance sheet, income statement and cash-flow statements till 2017.

Other information:

The firm will repay $400,000 of long-term debt each year starting 2013.

The firm has currently 2,020,000 shares outstanding.

The firms current share price in the market is $13.

The firms cost of capital (WACC) is 11%.

Question 2.2

What is the enterprise value of the firm?

Question 2.3

What is the estimated stock price of the firm (based on forecasted cash-flow)?

Question 2.4

Do you think that it is a good idea to invest in this stock, based on the assumptions and data given to you?

Assignment_ data 2018-Saved to my Mac a Search Sheet Share A Insert Page Layout Formulas Dta Review View Out CopyArial AutoSum Wrap Text | Fill c & Center Insert Delete Format Sort & Clear Formatting as Table Styles E41 Sales growth Projected Sales growth for terminal value cacuation Current labii.es/Sales Current assets3ales Coets of goods 80?Sales Net fked assets Sales Depreciation rate Interest rate on debt Interest earned on cash belances Tax rate Dividend payout rato 85% tCalculato based on last yoar s 85% (Based on current yoar data) 1 55% (Based on current year data) 55% ,Based on current year data) 75% (Based on current year data) 10% tonly based on last year Fixed Asset at cost 10 12 13 900% lbased on the average value of last year and current year debt 8 00% (based on the average value of last year and current year cash and marketable securities) 35% 'Based on current year data) 40% (Based on current year data) 15 16 Income statement 9,500,000 5,500,000) ,000,000) 4,000 320,000) 2,744.000 (60,400) 1783,800 13,440) 1.070,160 Costs of goods sold Interest earned on cash and marketable securities nterest payments on debt Proft before tax Taxe8 Proft atler tax 29 30 31 32 Retained eanings Balance sheet 800,000 1,500,000 Current assets Fixed assets 10,700,000 13,000,000) ,700,000 0,000,000 At cost Net fixed assets Current labii.es 800,000 Accuulated retained earnings Total liabillities and equity 4,500.000 1.800.000 0,000.000 47 Cost of capital Cash flow forecasting 100% Assignment_ data 2018-Saved to my Mac a Search Sheet Share A Insert Page Layout Formulas Dta Review View Out CopyArial AutoSum Wrap Text | Fill c & Center Insert Delete Format Sort & Clear Formatting as Table Styles E41 Sales growth Projected Sales growth for terminal value cacuation Current labii.es/Sales Current assets3ales Coets of goods 80?Sales Net fked assets Sales Depreciation rate Interest rate on debt Interest earned on cash belances Tax rate Dividend payout rato 85% tCalculato based on last yoar s 85% (Based on current yoar data) 1 55% (Based on current year data) 55% ,Based on current year data) 75% (Based on current year data) 10% tonly based on last year Fixed Asset at cost 10 12 13 900% lbased on the average value of last year and current year debt 8 00% (based on the average value of last year and current year cash and marketable securities) 35% 'Based on current year data) 40% (Based on current year data) 15 16 Income statement 9,500,000 5,500,000) ,000,000) 4,000 320,000) 2,744.000 (60,400) 1783,800 13,440) 1.070,160 Costs of goods sold Interest earned on cash and marketable securities nterest payments on debt Proft before tax Taxe8 Proft atler tax 29 30 31 32 Retained eanings Balance sheet 800,000 1,500,000 Current assets Fixed assets 10,700,000 13,000,000) ,700,000 0,000,000 At cost Net fixed assets Current labii.es 800,000 Accuulated retained earnings Total liabillities and equity 4,500.000 1.800.000 0,000.000 47 Cost of capital Cash flow forecasting 100%

Step by Step Solution

There are 3 Steps involved in it

It looks like youve uploaded an image of a worksheet containing financial data for a forecasting task To help with your question I can assist you in breaking down the given data and guiding you throug... View full answer

Get step-by-step solutions from verified subject matter experts