Question: Problem 2 (Required, 25 marks) (a) The face value and annual coupon rate of a 10-year bond is $1000 and 6% respectively. In addition, the

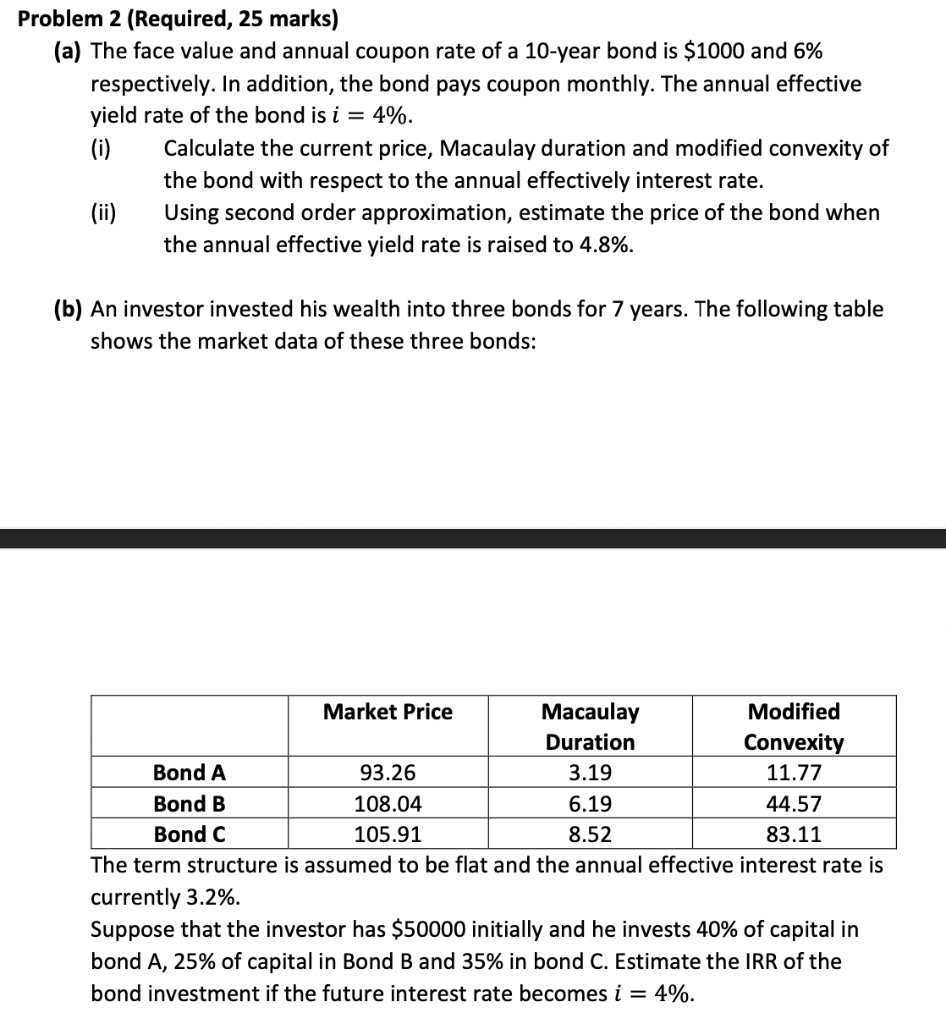

Problem 2 (Required, 25 marks) (a) The face value and annual coupon rate of a 10-year bond is $1000 and 6% respectively. In addition, the bond pays coupon monthly. The annual effective yield rate of the bond is i=4%. (i) Calculate the current price, Macaulay duration and modified convexity of the bond with respect to the annual effectively interest rate. (ii) Using second order approximation, estimate the price of the bond when the annual effective yield rate is raised to 4.8%. (b) An investor invested his wealth into three bonds for 7 years. The following table shows the market data of these three bonds: The term structure is assumed to be flat and the annual effective interest rate is currently 3.2%. Suppose that the investor has $50000 initially and he invests 40% of capital in bond A, 25% of capital in Bond B and 35% in bond C. Estimate the IRR of the bond investment if the future interest rate becomes i=4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts