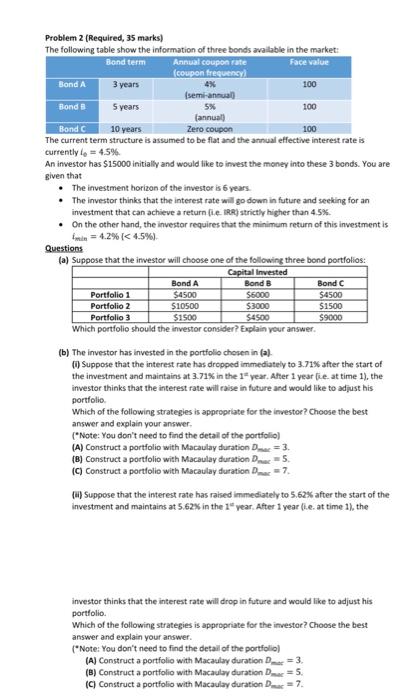

Question: Problem 2 (Required, 35 marks) The following table show the information of three bonds available in the market: Bond term Annual coupon rate Face value

Problem 2 (Required, 35 marks) The following table show the information of three bonds available in the market: Bond term Annual coupon rate Face value coupon frequency Bond A 3 years 4% 100 semi-annual Honda 5 years 5% 100 (annual Bond C 10 years Zero coupon 100 The current term structure is assumed to be fiat and the annual effective interest rate is currently lo = 4.5% An investor has $15000 initially and would like to invest the money into these 3 bonds. You are given that The investment horizon of the investor is 6 years The investor thinks that the interest rate will go down in future and seeking for an investment that can achieve a return ie IRR) strictly higher than 4.5%. . On the other hand, the investor requires that the minimum return of this investment is in = 4.2% [ 4.5%) Questions (a) Suppose that the investor will choose one of the following three bond portfolios: Capital Invested Bond A Bond Portfolio 1 $4500 $6000 $4500 Portfolio 2 $10500 $3000 $1500 Portfolio 3 $1500 54500 $9000 Which portfolio should the investor consider? Explain your answer. Bond B (b) The investor has invested in the portfolio chosen in (al Suppose that the interest rate has dropped immediately to 3.71% after the start of the investment and maintains at 3.71% in the 19 year. After 1 year lie at time 1), the investor thinks that the interest rate will raise in future and would like to adjust his portfolio Which of the following strategies is appropriate for the investor? Choose the best answer and explain your answer. (Note: You don't need to find the detail of the portfolio (A) Construct a portfolio with Macaulay duration D = 3. (B) Construct a portfolio with Macaulay duration D5 (C) Construct a portfolio with Macaulay duration=7 (W) Suppose that the interest rate has raised immediately to 5.62% after the start of the investment and maintains at 5.62% in the 1" year. After 1 year li.e. at time 1), the investor thinks that the interest rate will drop in future and would like to adjust his portfolio Which of the following strategies is appropriate for the investor? Choose the best answer and explain your answer. ("Note: You don't need to find the detail of the portfolio (A) Construct a portfolio with Macaulay duration D = 3. (B) Construct a portfolio with Macaulay duration D = 5. (C) Construct a portfolio with Macaulay duration D = 7 Problem 2 (Required, 35 marks) The following table show the information of three bonds available in the market: Bond term Annual coupon rate Face value coupon frequency Bond A 3 years 4% 100 semi-annual Honda 5 years 5% 100 (annual Bond C 10 years Zero coupon 100 The current term structure is assumed to be fiat and the annual effective interest rate is currently lo = 4.5% An investor has $15000 initially and would like to invest the money into these 3 bonds. You are given that The investment horizon of the investor is 6 years The investor thinks that the interest rate will go down in future and seeking for an investment that can achieve a return ie IRR) strictly higher than 4.5%. . On the other hand, the investor requires that the minimum return of this investment is in = 4.2% [ 4.5%) Questions (a) Suppose that the investor will choose one of the following three bond portfolios: Capital Invested Bond A Bond Portfolio 1 $4500 $6000 $4500 Portfolio 2 $10500 $3000 $1500 Portfolio 3 $1500 54500 $9000 Which portfolio should the investor consider? Explain your answer. Bond B (b) The investor has invested in the portfolio chosen in (al Suppose that the interest rate has dropped immediately to 3.71% after the start of the investment and maintains at 3.71% in the 19 year. After 1 year lie at time 1), the investor thinks that the interest rate will raise in future and would like to adjust his portfolio Which of the following strategies is appropriate for the investor? Choose the best answer and explain your answer. (Note: You don't need to find the detail of the portfolio (A) Construct a portfolio with Macaulay duration D = 3. (B) Construct a portfolio with Macaulay duration D5 (C) Construct a portfolio with Macaulay duration=7 (W) Suppose that the interest rate has raised immediately to 5.62% after the start of the investment and maintains at 5.62% in the 1" year. After 1 year li.e. at time 1), the investor thinks that the interest rate will drop in future and would like to adjust his portfolio Which of the following strategies is appropriate for the investor? Choose the best answer and explain your answer. ("Note: You don't need to find the detail of the portfolio (A) Construct a portfolio with Macaulay duration D = 3. (B) Construct a portfolio with Macaulay duration D = 5. (C) Construct a portfolio with Macaulay duration D = 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts