Question: Problem 2 Required: Based upon the information presented in Problem 1 and your calculation of financial statement materiality in Problem 1 , recalculate financial statement

Problem

Required:

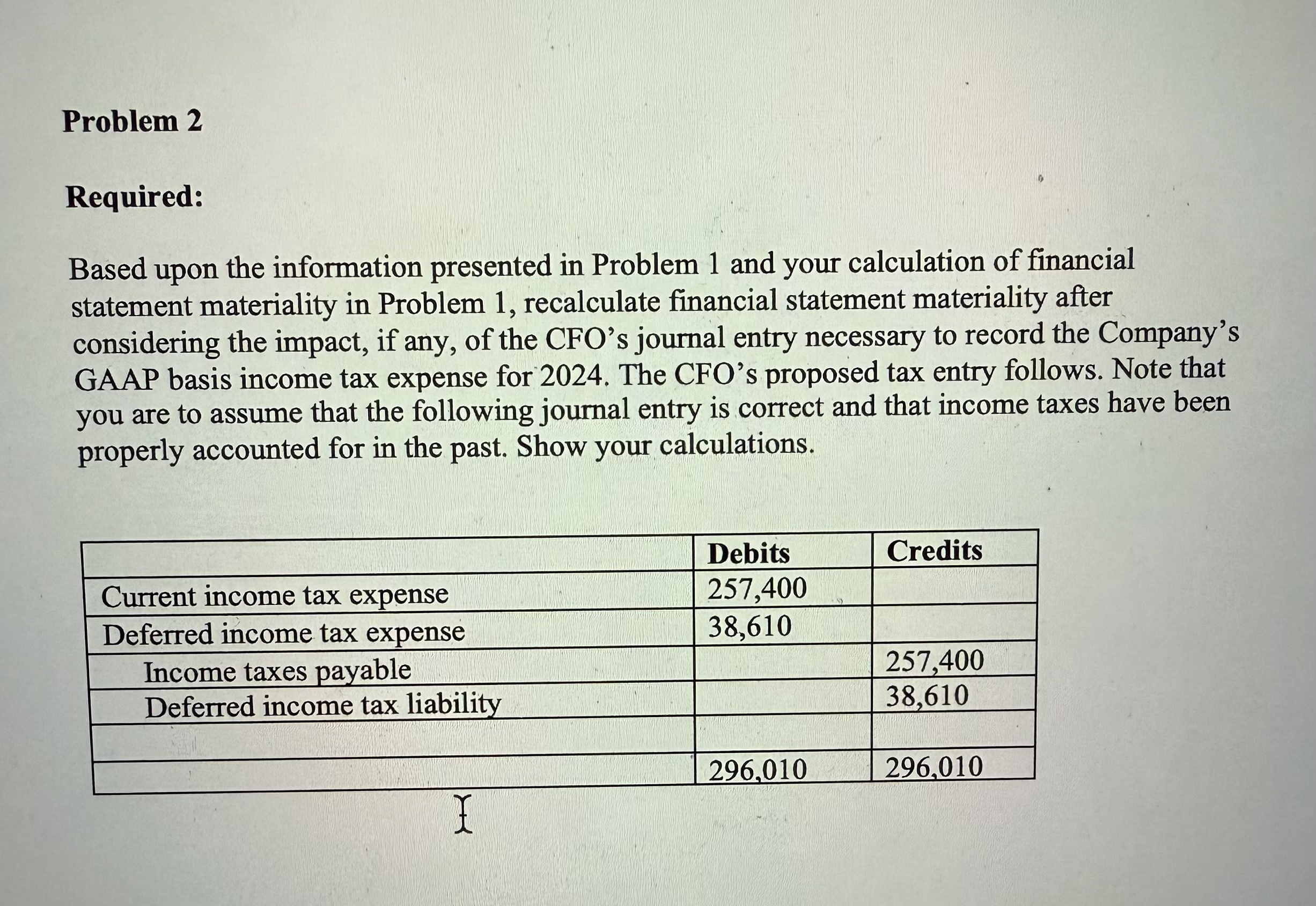

Based upon the information presented in Problem and your calculation of financial statement materiality in Problem recalculate financial statement materiality after considering the impact, if any, of the CFO's journal entry necessary to record the Company's GAAP basis income tax expense for The CFO's proposed tax entry follows. Note that you are to assume that the following journal entry is correct and that income taxes have been properly accounted for in the past. Show your calculations.

tableDebits,CreditsCurrent income tax expense,Deferred income tax expense,Income taxes payable,,Deferred income tax liability,,

Problem

You and your engagement team are in the process of planning your audit of Bravo Corporation the Company a mechanical contractor, as of and for the year ended December In connection with your planning activities, the Company's CFO, an experienced CPA, has provided you with the following trial balance. Based on your prior experience with the CFO and prior audits of the Company, you would not expect there to be any significant adjustments to the accounts.

tableBravo CorporationTrial BalanceDebitsCredits,CashAccounts receivable,Contract asset,EquipmentAccumulated depreciation,,Accounts payable,,Contract liability,,Common stock,,Retained earnings,Contract revenues,Cost of contract revenues,General and administrative expenses,,Depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock