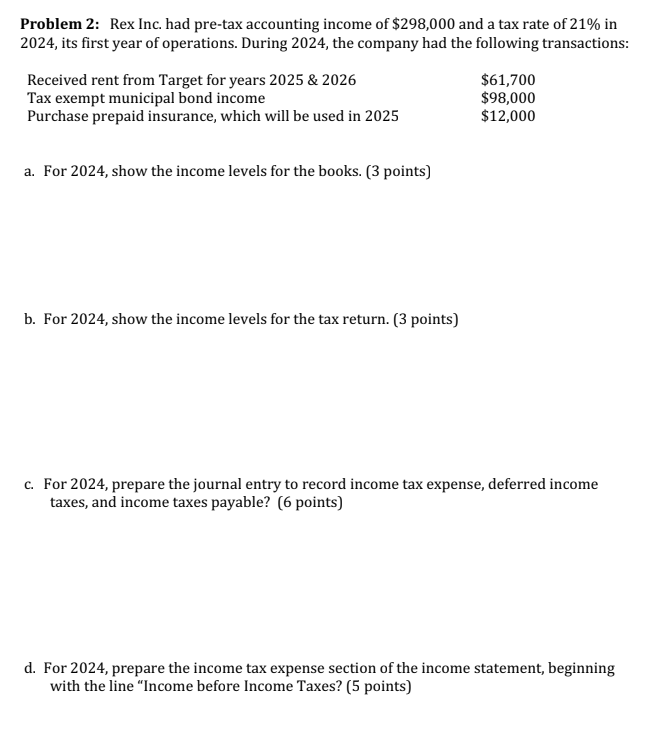

Question: Problem 2 : Rex Inc. had pre - tax accounting income of $ 2 9 8 , 0 0 0 and a tax rate

Problem : Rex Inc. had pretax accounting income of $ and a tax rate of in its first year of operations. During the company had the following transactions:

Received rent from Target for years &

Tax exempt municipal bond income

Purchase prepaid insurance, which will be used in

a For show the income levels for the books. points

$

$

$

b For show the income levels for the tax return. points

c For prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable? points

d For prepare the income tax expense section of the income statement, beginning with the line "Income before Income Taxes? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock