Question: Problem 2: Save the Planet (SP) Inc. is considering investment in a new project. The project will generate perpetual EBIT of 823,550. The effective tax

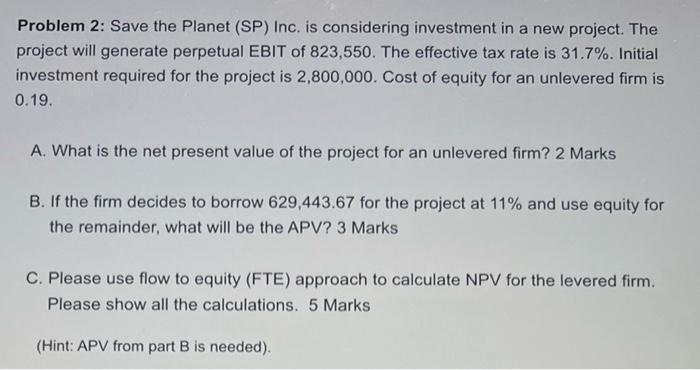

Problem 2: Save the Planet (SP) Inc. is considering investment in a new project. The project will generate perpetual EBIT of 823,550. The effective tax rate is 31.7%. Initial investment required for the project is 2,800,000. Cost of equity for an unlevered firm is 0.19 A. What is the net present value of the project for an unlevered firm? 2 Marks B. If the firm decides to borrow 629,443.67 for the project at 11% and use equity for the remainder, what will be the APV? 3 Marks C. Please use flow to equity (FTE) approach to calculate NPV for the levered firm. Please show all the calculations. 5 Marks (Hint: APV from part B is needed)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock