Question: Problem 2 (See pages 177- 178 and Practice Problem 1 with solution, pages 181 -83) Surgery Supplies Inc. expects sales next year to be $8,400,000

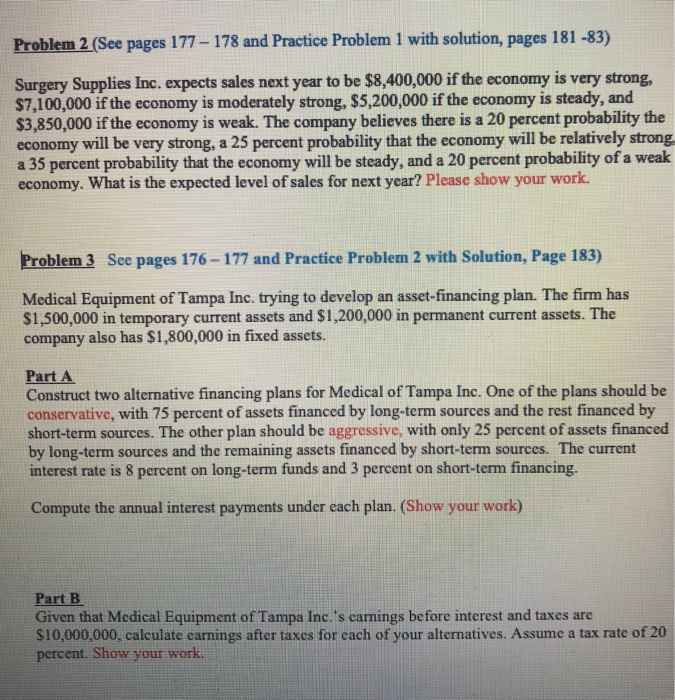

Problem 2 (See pages 177- 178 and Practice Problem 1 with solution, pages 181 -83) Surgery Supplies Inc. expects sales next year to be $8,400,000 if the economy is very strong, $7,100,000 if the economy is moderately strong, $5,200,000 if the economy is steady, and $3,850,000 if the economy is weak. The company believes there is a 20 percent probability the economy will be very strong, a 25 percent probability that the economy will be relatively strong a 35 percent probability that the economy will be steady, and a 20 percent probability of a weak economy. What is the expected level of sales for next year? Please show your work. Problem 3 See pages 176-177 and Practice Problem 2 with Solution, Page 183) Medical Equipment of Tampa Inc. trying to develop $1,500,000 in temporary current assets and $1,200,000 in permanent current assets. The company also has $1,800,000 in fixed assets. an asset-financing plan. The firm has Part A Construct two alternative financing plans for Medical of Tampa Inc. One of the plans should be conservative, with 75 percent of assets financed by long-term sources and the rest financed by short-term sources. The other plan should be aggressive, with only 25 percent of assets financed by long-term sources and the remaining assets financed by short-term sources. The current interest rate is 8 percent on long-term funds and 3 percent on short-term financing. Compute the annual interest payments under each plan. (Show your work) Part B Given that Medical Equipment of Tampa Inc.'s eamings before interest and taxes are $10,000,000, calculate earnings after taxes for cach of your alternatives. Assume a tax rate of 20 percent. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts