Question: Problem 2 (See pages 296 - 307) You are called in as a financial analyst to appraise the bonds of Merck & Company, Inc. The

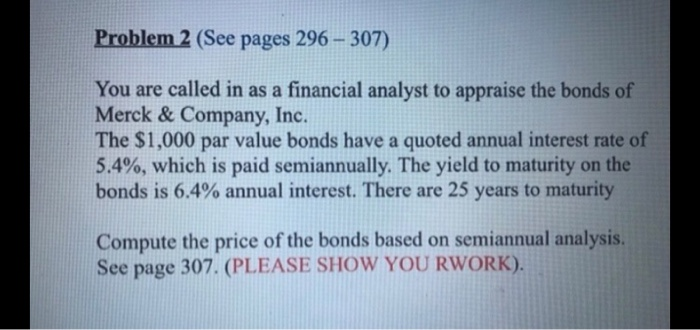

Problem 2 (See pages 296 - 307) You are called in as a financial analyst to appraise the bonds of Merck & Company, Inc. The $1,000 par value bonds have a quoted annual interest rate of 5.4%, which is paid semiannually. The yield to maturity on the bonds is 6.4% annual interest. There are 25 years to maturity Compute the price of the bonds based on semiannual analysis. See page 307. (PLEASE SHOW YOU RWORK)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts