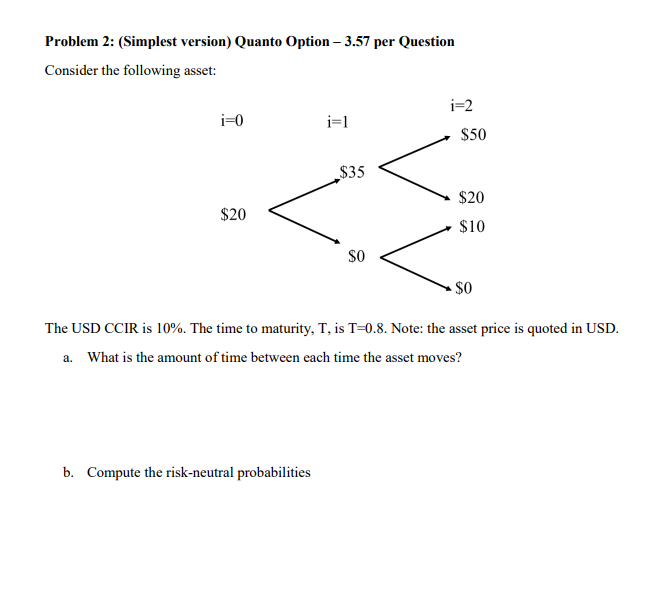

Question: Problem 2: (Simplest version) Quanto Option - 3.57 per Question Consider the following asset: 1-2 i-0 i-1 $50 $35 $20 $20 $10 SO $0 The

Problem 2: (Simplest version) Quanto Option - 3.57 per Question Consider the following asset: 1-2 i-0 i-1 $50 $35 $20 $20 $10 SO $0 The USD CCIR is 10%. The time to maturity, T, is T-0.8. Note: the asset price is quoted in USD. a. What is the amount of time between each time the asset moves? b. Compute the risk-neutral probabilities Now, assume that there is a European put option on the asset in USD with strike price K-$20 and expiration T-0.8. c. Compute the price of the put option Now, we are going to price a Quanto option. A quanto option is an option whose payoff is settled in a different currency. Consider a Quanto European Option with expiration T-0.4 and strike price K-S20 whose payoff at expiration at T-0.4 is settled in euros at the spot rate at expiration. d. Compute the payoff of the Quanto Put option in each state at t-0.4 for a given spot price of Euro Mo4 The Euro follows the following process: i-o $1.3 S1.25 S1.1 This means that in at t-0.4, we have 4 possible scenarios (either the stock goes up or down, either the Euro goes up or down). e. Specify the payoffs in Euro in each of the possible scenarios: f. The way to price these Quanto options is to create a portfolio that is risk-free (so basically hedge the risk from the Quanto Option). How many assets would we need to hedge the risk? (i.e., what is the number of elements of the portfolio 110?) g. Which would be these assets in this case? Problem 2: (Simplest version) Quanto Option - 3.57 per Question Consider the following asset: 1-2 i-0 i-1 $50 $35 $20 $20 $10 SO $0 The USD CCIR is 10%. The time to maturity, T, is T-0.8. Note: the asset price is quoted in USD. a. What is the amount of time between each time the asset moves? b. Compute the risk-neutral probabilities Now, assume that there is a European put option on the asset in USD with strike price K-$20 and expiration T-0.8. c. Compute the price of the put option Now, we are going to price a Quanto option. A quanto option is an option whose payoff is settled in a different currency. Consider a Quanto European Option with expiration T-0.4 and strike price K-S20 whose payoff at expiration at T-0.4 is settled in euros at the spot rate at expiration. d. Compute the payoff of the Quanto Put option in each state at t-0.4 for a given spot price of Euro Mo4 The Euro follows the following process: i-o $1.3 S1.25 S1.1 This means that in at t-0.4, we have 4 possible scenarios (either the stock goes up or down, either the Euro goes up or down). e. Specify the payoffs in Euro in each of the possible scenarios: f. The way to price these Quanto options is to create a portfolio that is risk-free (so basically hedge the risk from the Quanto Option). How many assets would we need to hedge the risk? (i.e., what is the number of elements of the portfolio 110?) g. Which would be these assets in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts