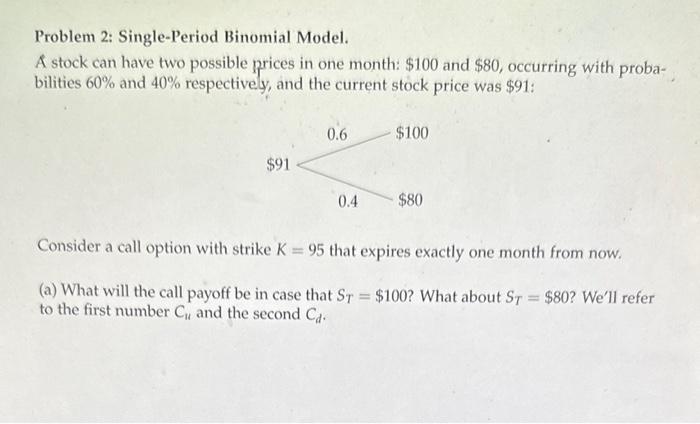

Question: Problem 2: Single-Period Binomial Model. A stock can have two possible prices in one month: $100 and $80, occurring with probabilities 60% and 40% respectively,

Problem 2: Single-Period Binomial Model. A stock can have two possible prices in one month: $100 and $80, occurring with probabilities 60% and 40% respectively, and the current stock price was $91 : Consider a call option with strike K=95 that expires exactly one month from now. (a) What will the call payoff be in case that ST=$100 ? What about ST=$80 ? We'll refer to the first number CH and the second Cd. (b) What portfolio (,B) of the underlying stock and risk-free bonds will replicate the call option? (c) What is the no-arbitrage price of the call option, assuming the continuously compounded risk-free rate is 2% annually? (d) What are the risk-neutral probabilities of the two states? Price the call with riskneutral pricing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts