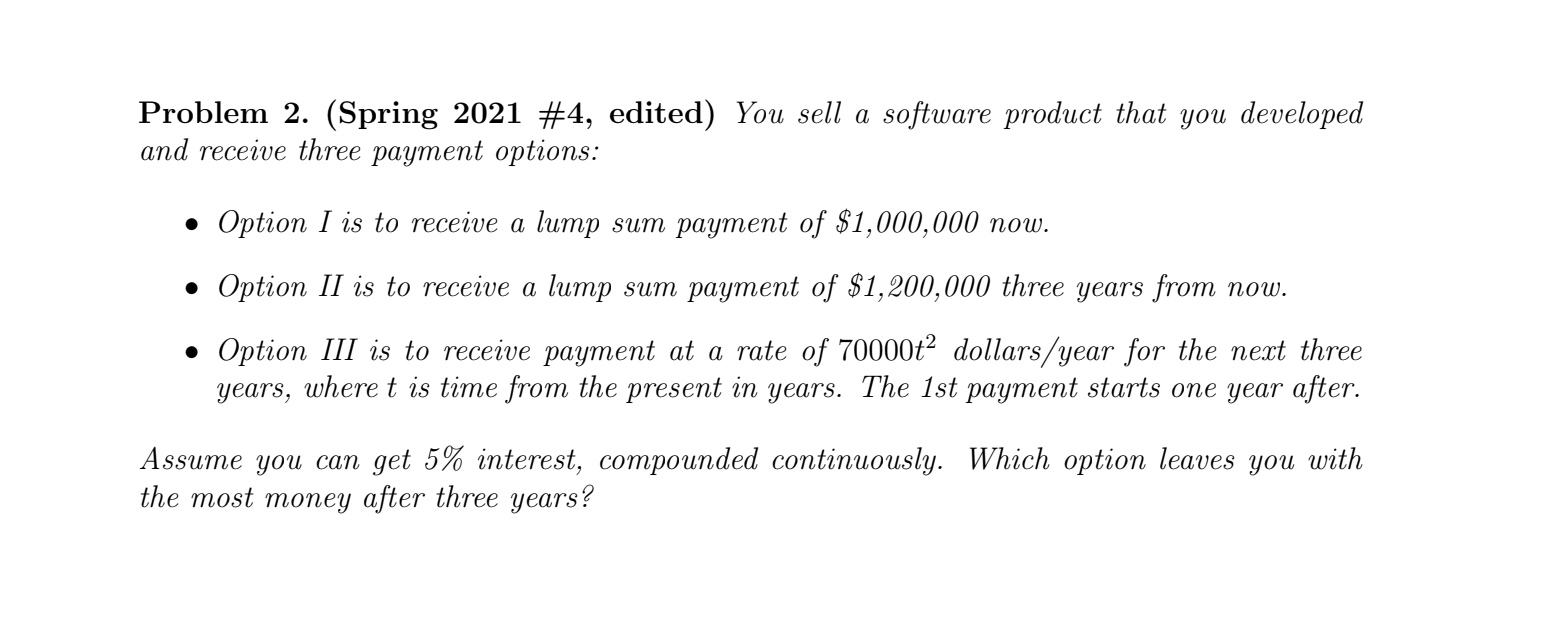

Question: Problem 2 . ( Spring 2 0 2 1 # 4 , edited ) You sell a software product that you developed and receive three

Problem Spring # edited You sell a software product that you developed

and receive three payment options:

Option I is to receive a lump sum payment of $ now.

Option II is to receive a lump sum payment of $ three years from now.

Option III is to receive payment at a rate of dollarsyear for the next three

years, where is time from the present in years. The st payment starts one year after.

Assume you can get interest, compounded continuously. Which option leaves you with

the most money after three years?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock