Question: Problem 2: Stock X is expected to pay a dividend in one year of $5. That dividend is expected to grow by 5% each year

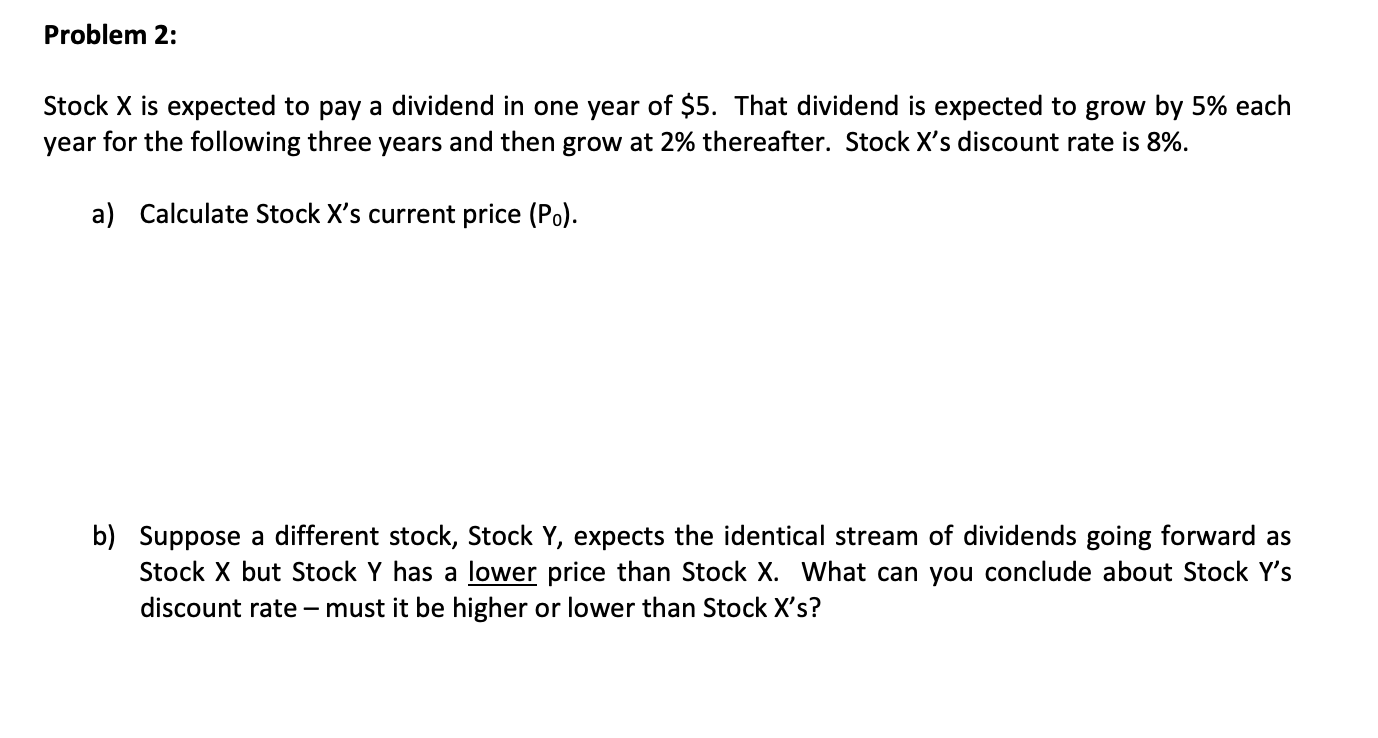

Problem 2: Stock X is expected to pay a dividend in one year of $5. That dividend is expected to grow by 5% each year for the following three years and then grow at 2% thereafter. Stock X's discount rate is 8%. a) Calculate Stock X's current price (Po). b) Suppose a different stock, Stock Y, expects the identical stream of dividends going forward as Stock X but Stock Y has a lower price than Stock X. What can you conclude about Stock Y's discount rate - must it be higher or lower than Stock X's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts