Question: Problem 2 Suppose that a firm forms at date 0 and will cease operations at the end of date 3. At date 0, it can

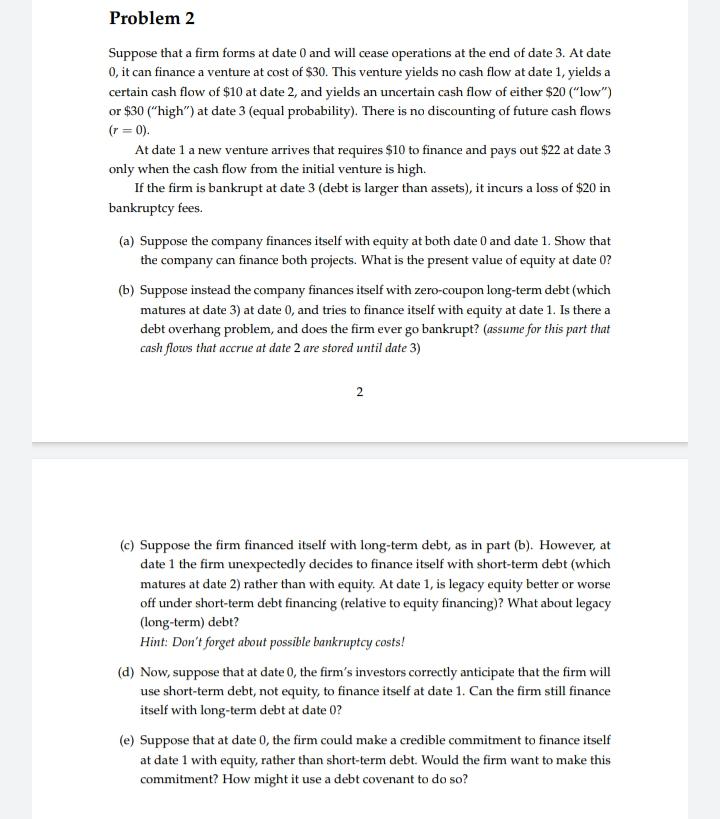

Problem 2 Suppose that a firm forms at date 0 and will cease operations at the end of date 3. At date 0, it can finance a venture at cost of $30. This venture yields no cash flow at date 1, yields a certain cash flow of $10 at date 2, and yields an uncertain cash flow of either $20 ("low") or $30 ("high") at date 3 (equal probability). There is no discounting of future cash flows (r = 0). At date 1 a new venture arrives that requires $10 to finance and pays out $22 at date 3 only when the cash flow from the initial venture is high. If the firm is bankrupt at date 3 (debt is larger than assets), it incurs a loss of $20 in bankruptcy fees. (a) Suppose the company finances itself with equity at both date 0 and date 1. Show that the company can finance both projects. What is the present value of equity at date 0? (b) Suppose instead the company finances itself with zero-coupon long-term debt (which matures at date 3) at date 0, and tries to finance itself with equity at date 1. Is there a debt overhang problem, and does the firm ever go bankrupt? (assume for this part that cash flows that accrue at date 2 are stored until date 3) 2 (c) Suppose the firm financed itself with long-term debt, as in part (b). However, at date 1 the firm unexpectedly decides to finance itself with short-term debt (which matures at date 2) rather than with equity. At date 1, is legacy equity better or worse off under short-term debt financing (relative to equity financing)? What about legacy (long-term) debt? Hint. Don't forget about possible bankruptcy costs! (d) Now, suppose that at date 0, the firm's investors correctly anticipate that the firm will use short-term debt, not equity, to finance itself at date 1. Can the firm still finance itself with long-term debt at date 0? (e) Suppose that at date 0, the firm could make a credible commitment to finance itself at date 1 with equity, rather than short-term debt. Would the firm want to make this commitment? How might it use a debt covenant to do so? Problem 2 Suppose that a firm forms at date 0 and will cease operations at the end of date 3. At date 0, it can finance a venture at cost of $30. This venture yields no cash flow at date 1, yields a certain cash flow of $10 at date 2, and yields an uncertain cash flow of either $20 ("low") or $30 ("high") at date 3 (equal probability). There is no discounting of future cash flows (r = 0). At date 1 a new venture arrives that requires $10 to finance and pays out $22 at date 3 only when the cash flow from the initial venture is high. If the firm is bankrupt at date 3 (debt is larger than assets), it incurs a loss of $20 in bankruptcy fees. (a) Suppose the company finances itself with equity at both date 0 and date 1. Show that the company can finance both projects. What is the present value of equity at date 0? (b) Suppose instead the company finances itself with zero-coupon long-term debt (which matures at date 3) at date 0, and tries to finance itself with equity at date 1. Is there a debt overhang problem, and does the firm ever go bankrupt? (assume for this part that cash flows that accrue at date 2 are stored until date 3) 2 (c) Suppose the firm financed itself with long-term debt, as in part (b). However, at date 1 the firm unexpectedly decides to finance itself with short-term debt (which matures at date 2) rather than with equity. At date 1, is legacy equity better or worse off under short-term debt financing (relative to equity financing)? What about legacy (long-term) debt? Hint. Don't forget about possible bankruptcy costs! (d) Now, suppose that at date 0, the firm's investors correctly anticipate that the firm will use short-term debt, not equity, to finance itself at date 1. Can the firm still finance itself with long-term debt at date 0? (e) Suppose that at date 0, the firm could make a credible commitment to finance itself at date 1 with equity, rather than short-term debt. Would the firm want to make this commitment? How might it use a debt covenant to do so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts