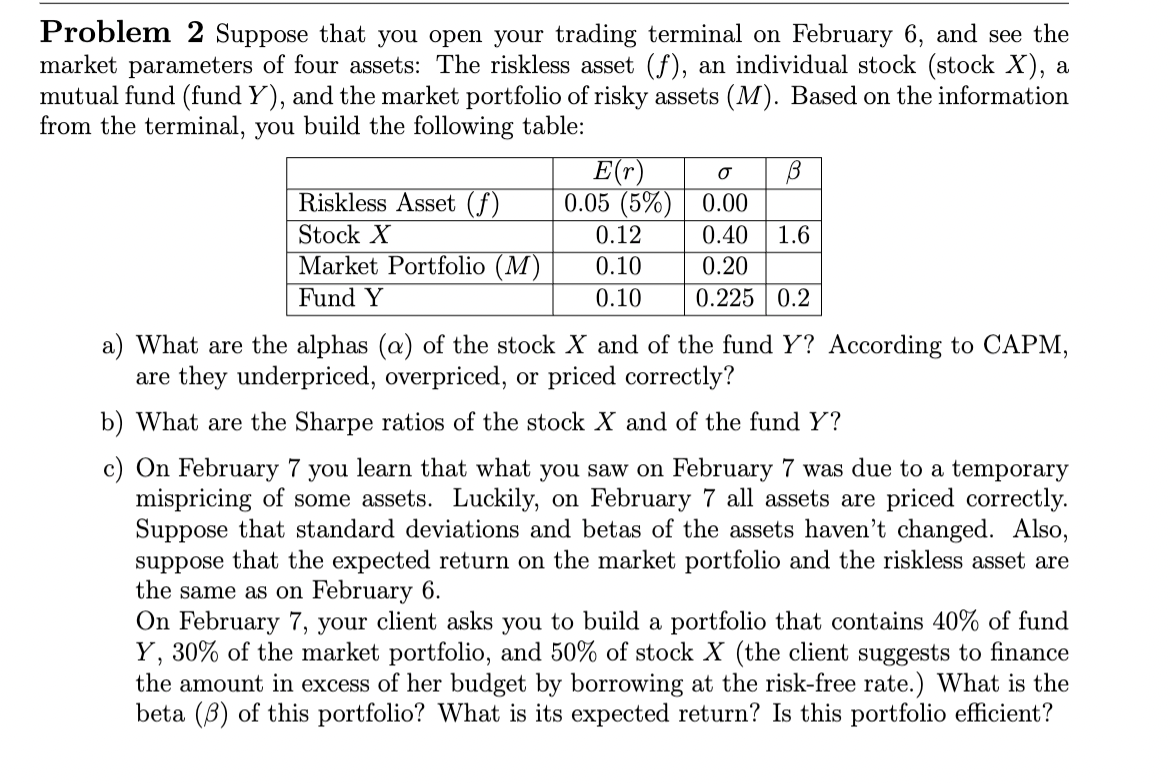

Question: Problem 2 Suppose that you open your trading terminal on February 6 , and see the market parameters of four assets: The riskless asset (

Problem Suppose that you open your trading terminal on February and see the

market parameters of four assets: The riskless asset an individual stock stock a

mutual fund fund and the market portfolio of risky assets Based on the information

from the terminal, you build the following table:

a What are the alphas of the stock and of the fund According to CAPM,

are they underpriced, overpriced, or priced correctly?

b What are the Sharpe ratios of the stock and of the fund

c On February you learn that what you saw on February was due to a temporary

mispricing of some assets. Luckily, on February all assets are priced correctly.

Suppose that standard deviations and betas of the assets haven't changed. Also,

suppose that the expected return on the market portfolio and the riskless asset are

the same as on February

On February your client asks you to build a portfolio that contains of fund

of the market portfolio, and of stock the client suggests to finance

the amount in excess of her budget by borrowing at the riskfree rate. What is the

beta of this portfolio? What is its expected return? Is this portfolio efficient?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock