Question: Problem 2. Ten years from now, you plan on taking a year's unpai d biking across the US from d vaca tion an Phifadefphra to

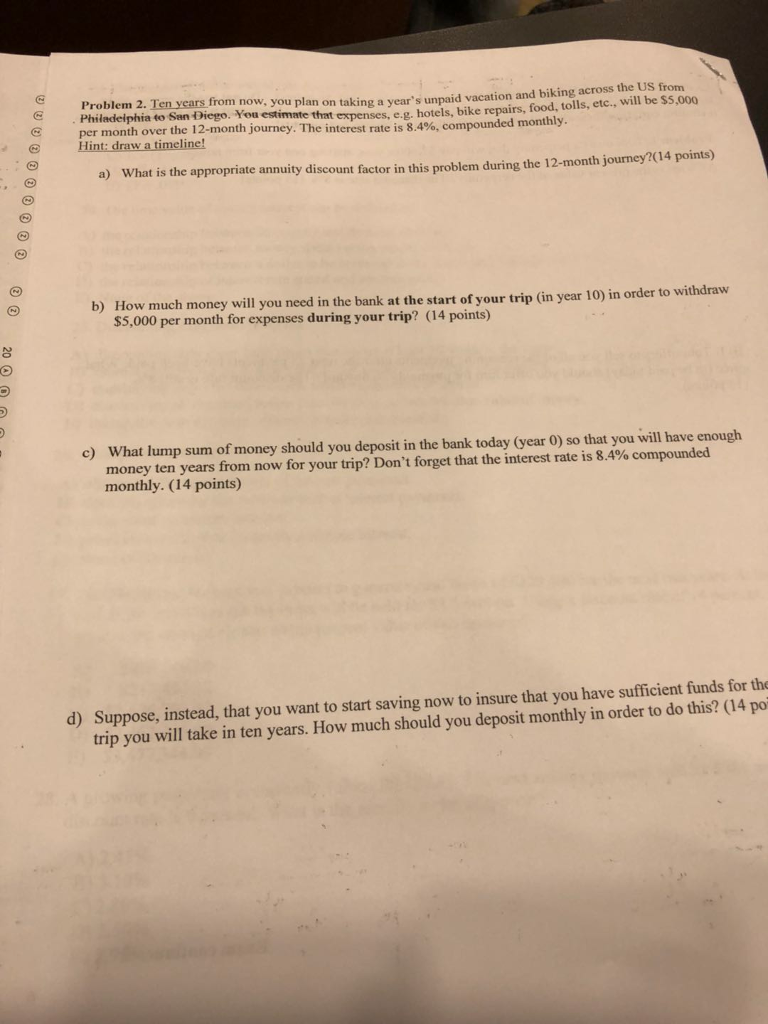

Problem 2. Ten years from now, you plan on taking a year's unpai d biking across the US from d vaca tion an Phifadefphra to San iego. You estimnte that expenses, e.g. hotels, bike repairs, food, tolls, etc, Wll be 5,000 per month over the 12-month journey. The interest rate is 8.4%, compounded monthly Hint: draw a timeline! t is the appropriate annuity discount factor in this problem during the 12-month journey214 points) b) How much money will you need in the bank at the start of your trip (in year 10) in order to withdraw $5,000 per month for expenses during your trip? (14 points) c) What lump sum of money should you deposit in the bank today (year 0) so that you will have enough money ten years from now for your trip? Don't forget that the interest rate is 8.4% compounded monthly. (14 points) d) Suppose, instead, that you want to start saving now to insure that you have sufficient funds for th trip you will take in ten years. How much should you deposit monthly in order to do this? (14 po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts