Question: Problem 2 The Carly Company is showing $ 9 , 2 5 6 in their Ledger Cash account on March 3 1 , 2

Problem

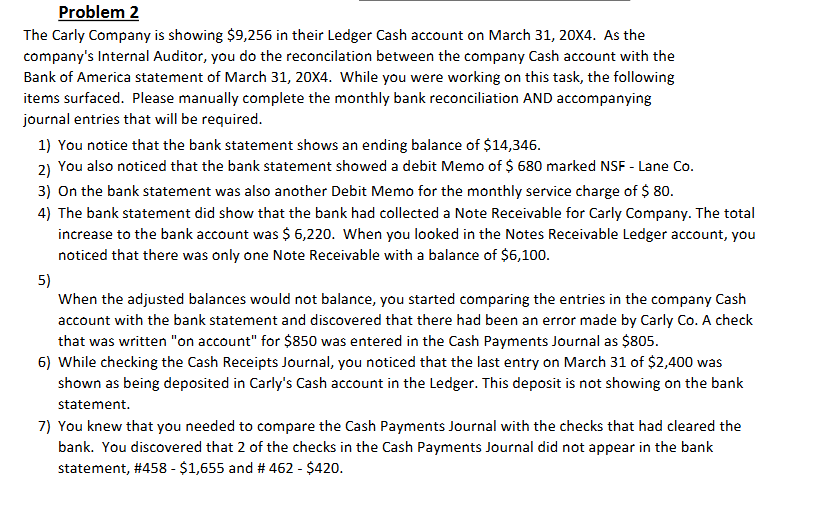

The Carly Company is showing $ in their Ledger Cash account on March X As the company's Internal Auditor, you do the reconcilation between the company Cash account with the Bank of America statement of March X While you were working on this task, the following items surfaced. Please manually complete the monthly bank reconciliation AND accompanying journal entries that will be required.

You notice that the bank statement shows an ending balance of $

You also noticed that the bank statement showed a debit Memo of $ marked NSF Lane Co

On the bank statement was also another Debit Memo for the monthly service charge of $

The bank statement did show that the bank had collected a Note Receivable for Carly Company. The total increase to the bank account was $ When you looked in the Notes Receivable Ledger account, you noticed that there was only one Note Receivable with a balance of $

When the adjusted balances would not balance, you started comparing the entries in the company Cash account with the bank statement and discovered that there had been an error made by Carly Co A check that was written on account" for $ was entered in the Cash Payments Journal as $

While checking the Cash Receipts Journal, you noticed that the last entry on March of $ was shown as being deposited in Carly's Cash account in the Ledger. This deposit is not showing on the bank statement.

You knew that you needed to compare the Cash Payments Journal with the checks that had cleared the bank. You discovered that of the checks in the Cash Payments Journal did not appear in the bank statement, #$ and # $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock