Question: Problem 2 The following information is available concerning transactions between Polly Co. and Susanna Inc. its subsidiary Susanna for the current year. Susanna purchased land

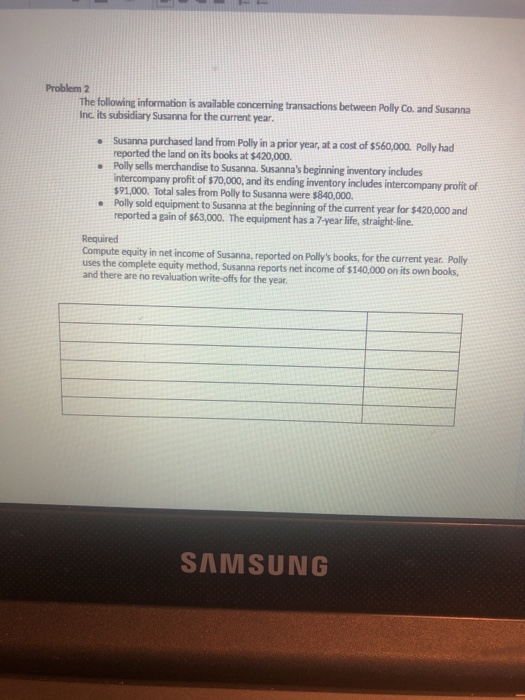

Problem 2 The following information is available concerning transactions between Polly Co. and Susanna Inc. its subsidiary Susanna for the current year. Susanna purchased land from Polly in a prior year, at a cost of $560,000. Polly had reported the land on its books at $420,000. Polly sells merchandise to Susanna Susanna's beginning inventory includes intercompany profit of $70,000, and its ending inventory includes intercompany profit of $91,000. Total sales from Polly to Susanna were $840,000. Polly sold equipment to Susanna at the beginning of the current year for $420,000 and reported a gain of $63,000. The equipment has a 7-year life, straight-line. Required Compute equity in net income of Susanna, reported on Polly's books, for the current year. Polly uses the complete equity method, Susanna reports net income of $140,000 on its own books, and there are no revaluation write-offs for the year. SAMSUNG Problem 2 The following information is available concerning transactions between Polly Co. and Susanna Inc. its subsidiary Susanna for the current year. Susanna purchased land from Polly in a prior year, at a cost of $560,000. Polly had reported the land on its books at $420,000. Polly sells merchandise to Susanna Susanna's beginning inventory includes intercompany profit of $70,000, and its ending inventory includes intercompany profit of $91,000. Total sales from Polly to Susanna were $840,000. Polly sold equipment to Susanna at the beginning of the current year for $420,000 and reported a gain of $63,000. The equipment has a 7-year life, straight-line. Required Compute equity in net income of Susanna, reported on Polly's books, for the current year. Polly uses the complete equity method, Susanna reports net income of $140,000 on its own books, and there are no revaluation write-offs for the year. SAMSUNG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts