Question: Problem 2 The main concept to remember from this question is that an exchange will alter the terms of options contracts if a company decides

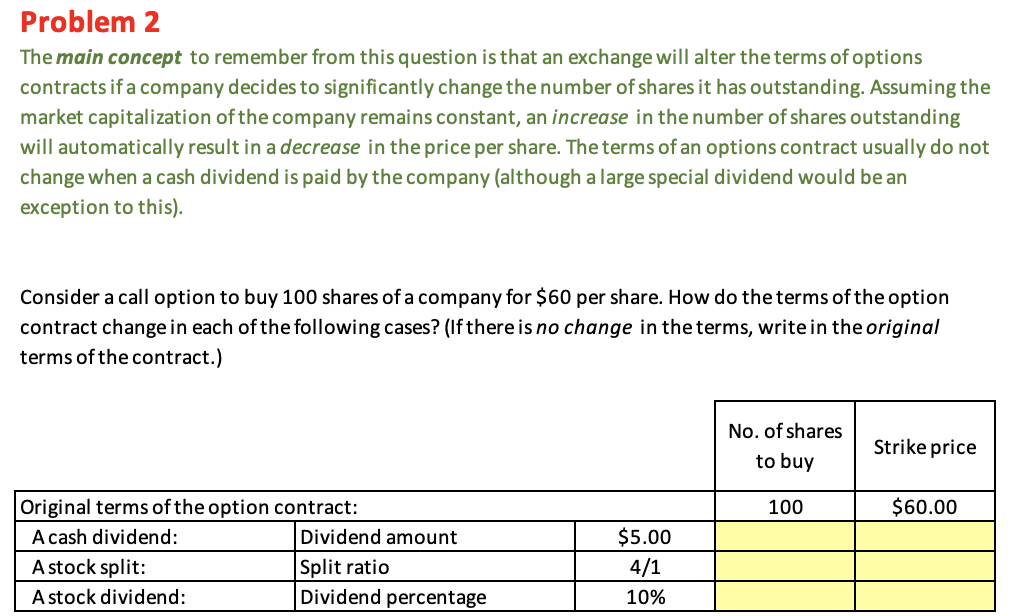

Problem 2 The main concept to remember from this question is that an exchange will alter the terms of options contracts if a company decides to significantly change the number of shares it has outstanding. Assuming the market capitalization of the company remains constant, an increase in the number of shares outstanding will automatically result in a decrease in the price per share. The terms of an options contract usually do not change when a cash dividend is paid by the company (although a large special dividend would be an exception to this) Consider a call option to buy 100 shares of a company for $60 per share. How do the terms of the option contract change in each of the following cases? (If there is no change in the terms, write in the original terms of the contract.) No. of shares to bu Strike price 100 $60.00 Original terms of the option contract: A cash dividend: Dividend amount A stock split: Split ratio A stock dividend: Dividend percentage $5.00 4/1 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts