Question: PROBLEM 2 Two bonds are purchased for the same price to yield 5%. Bond X has 4% annual coupons and matures for its face value

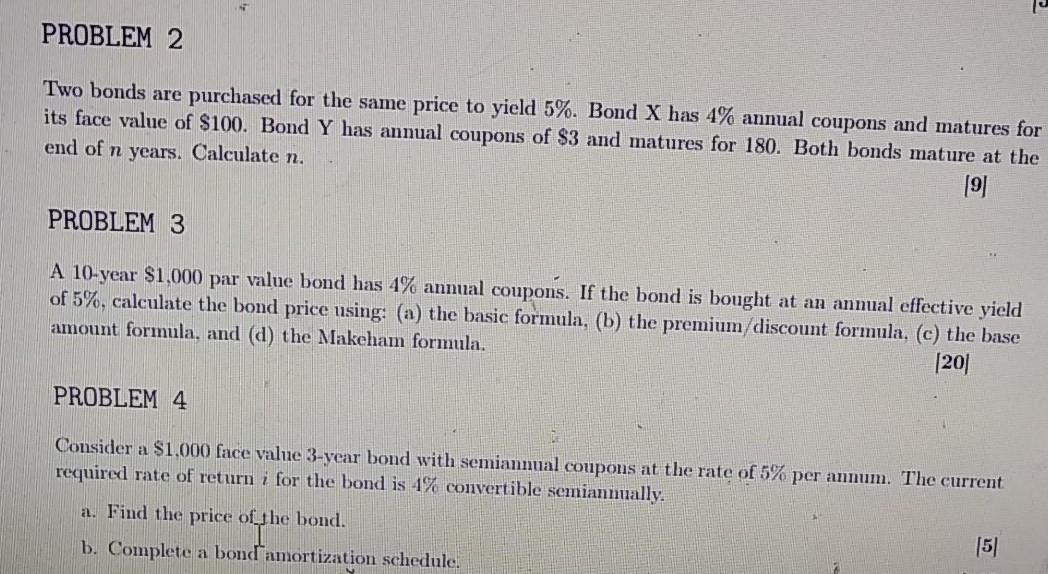

PROBLEM 2 Two bonds are purchased for the same price to yield 5%. Bond X has 4% annual coupons and matures for its face value of $100. Bond Y has annual coupons of $3 and matures for 180. Both bonds mature at the end of n years. Calculate n. (9) PROBLEM 3 A 10-year $1,000 par value bond has 4% annual coupons. If the bond is bought at an annual effective yield of 5%, calculate the bond price using: (a) the basic formula, (b) the premium discount formula, (c) the base amount formula, and (d) the Makeham formula. [20 PROBLEM 4 Consider a $1.000 face value 3-year bond with semianmal coupons at the rate of 5% per annum. The current required rate of return i for the bond is 1% convertible semiannually. a. Find the price of the bond. [5 b. Complete a bond amortization schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts