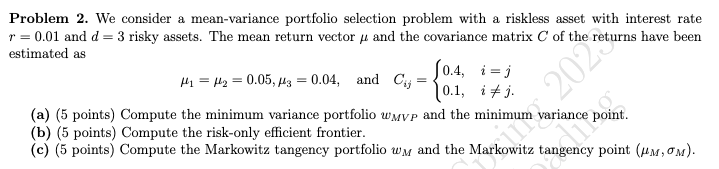

Question: Problem 2. We consider 3 meshvariance portfolio selection problem with e. riskless asset with interest rate r = [1.01 and d = 3 risky assets.

Problem 2. We consider 3 meshvariance portfolio selection problem with e. riskless asset with interest rate r = [1.01 and d = 3 risky assets. The mean return vector p. and the omnrisnoe matrix C of the returns have been estimated as [1.4, i=j 0.1, is j. {s} {5 points] Compute the minimum variance portfolio snow:- and the minimum 1mrienoe point. {h} {5 points} Compute the riskonly efficient frontier. {o} [5 points} Compute the Msrltowits tango-hey portfolio to\" and the Msrkowite tangeney point {pm,d'M:I-. #1 = to = onset; = one and 0.1.: {

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts