Question: Problem 2: We showed in class that with corporate and personal taxes the PV(Tax Shields) can be substantially different from TD. Using the formula from

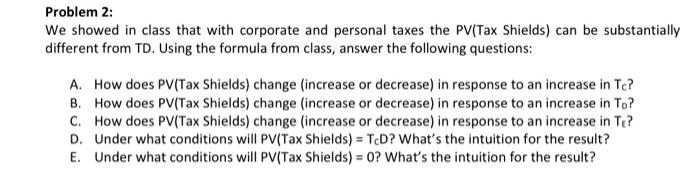

Problem 2: We showed in class that with corporate and personal taxes the PV(Tax Shields) can be substantially different from TD. Using the formula from class, answer the following questions: A. How does PV(Tax Shields) change (increase or decrease) in response to an increase in Tc? B. How does PV(Tax Shields) change increase or decrease) in response to an increase in To? C. How does PV(Tax Shields) change (increase or decrease) in response to an increase in Te? D. Under what conditions will PV(Tax Shields) = TcD? What's the intuition for the result? E. Under what conditions will PV(Tax Shields) = 0? What's the intuition for the result? Problem 2: We showed in class that with corporate and personal taxes the PV(Tax Shields) can be substantially different from TD. Using the formula from class, answer the following questions: A. How does PV(Tax Shields) change (increase or decrease) in response to an increase in Tc? B. How does PV(Tax Shields) change increase or decrease) in response to an increase in To? C. How does PV(Tax Shields) change (increase or decrease) in response to an increase in Te? D. Under what conditions will PV(Tax Shields) = TcD? What's the intuition for the result? E. Under what conditions will PV(Tax Shields) = 0? What's the intuition for the result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts